Now, here’s our labor market insights for August 2025, written by Matt Duffy (prepared without the use of AI):

Key Takeaways:

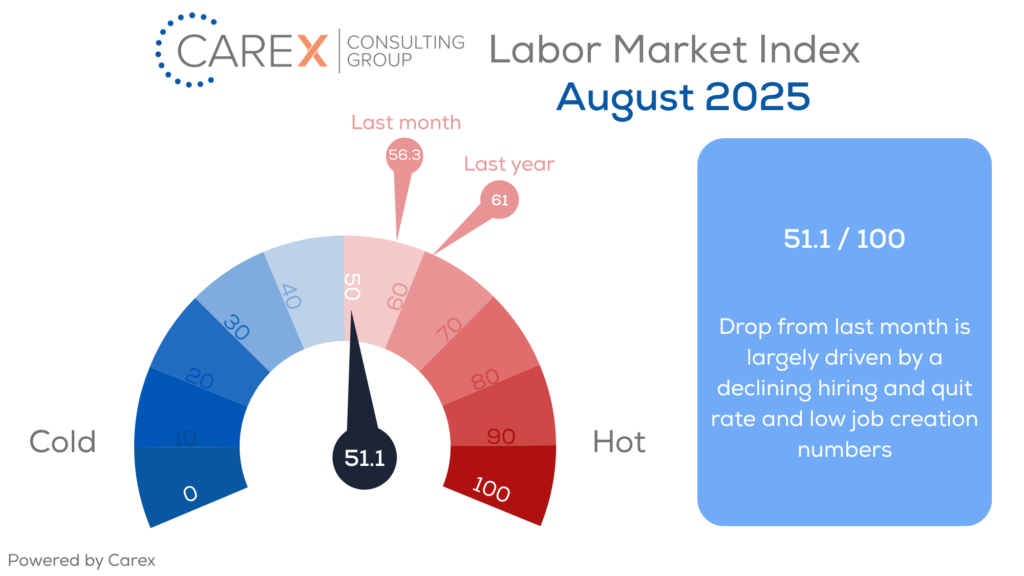

We often think of the labor market as being in constant motion – either heating up or cooling down (much like the ongoing thermostat battle in my house). But today, that perpetual motion seems to have stalled. As highlighted in the “by the numbers” section below, most indicators are stuck in neutral. Aside from the job creation metric (which I’ll address in a moment), nearly all data points are languishing in the doldrums. Even the trend lines, which usually offer a clear view of where we’ve been and where we’re headed are now murky, making it nearly impossible to forecast what’s next.

Consider this: ahead of this month’s jobs report, “expert” forecasts ranged from no job growth to 176,000 new positions. That’s the economic equivalent of a meteorologist predicting tomorrow’s temperature will fall somewhere between 10 and 115 degrees.

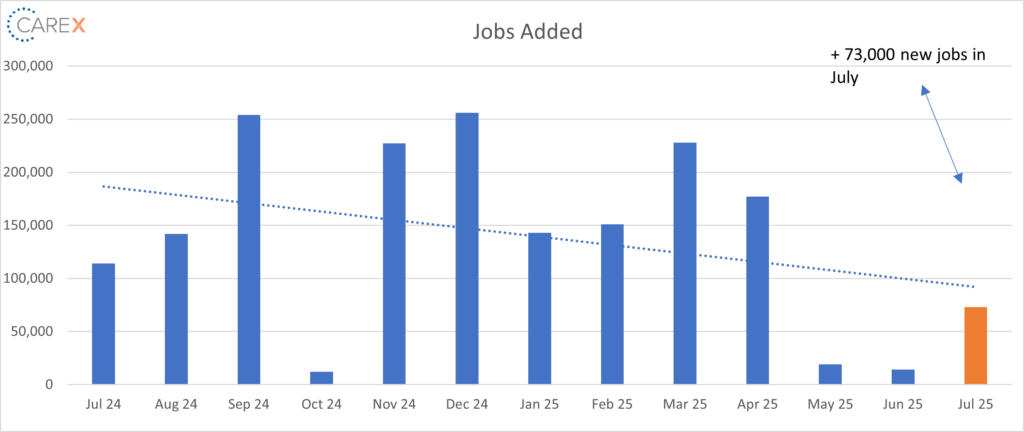

That said, one data point does deserve special attention: job creation.

Now, if you know me, you know I don’t put much stock in the monthly job creation figures. These numbers are frequently revised and can unintentionally create a misleading picture of the labor market’s health. Because of that, I usually avoid discussing this data point altogether. But the latest revisions are too significant to ignore. Last month, the U.S. economy added just 73,000 jobs. On its own, that number is soft, but not especially alarming. What is alarming, however, are the revisions to May and June: the job counts for those two months were revised down by a combined 258,000, to just 19,000 and 14,000 jobs, respectively. That makes June’s job growth the weakest in more than four years. As a result, the three-month moving average has fallen to just 35,000—a level not seen since 2020 and one of the weakest in the past five years.

To be clear, revisions aren’t unusual. Around this time last year, the Bureau of Labor Statistics revealed that 818,000 fewer jobs had been created over a 12-month period than originally reported. But revisions of this magnitude over such a short window are rare – and troubling. This signals a shift in the narrative: from a resilient labor market to one showing increasing signs of fragility. The key question now is whether this stagnation is a temporary pause, perhaps driven by tariff uncertainty, delayed hiring, or erratic demand – or whether we’re seeing the early signs of something more structural: tighter immigration policies, shifting trade dynamics, or the accelerating influence of AI.

It’s also important to keep context in mind. With immigration slowing, the labor force isn’t growing as quickly as it used to. That means we now need fewer new jobs to maintain stability in the labor market. So, while the current pace of job growth would have been troubling in the past, today it may not be as dire.

By the numbers:

- New Jobs – the U.S. added 73,000 new jobs in July

- Health care and social assistance combined for some 94% of the job growth

- The biggest employment changes came from manufacturing (-11K; tariffs?), professional & business services excluding temp agencies (-10K), and the government (-10K)

- Unemployment increased slightly to 4.2%, up from 4.1% the previous month

- The rate is higher than the 50-year low of 3.4% seen in April 2023, but lower than the rates observed in previous years leading up to the Pandemic

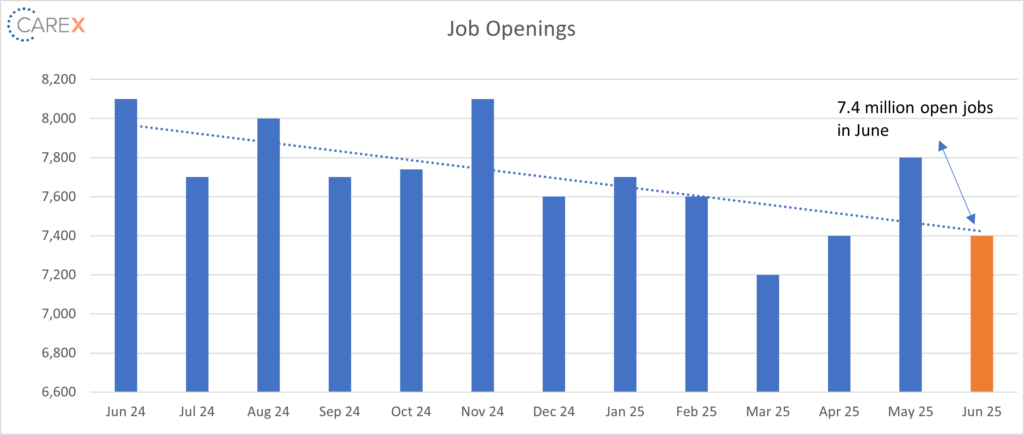

- Job openings dropped to 7.4 million, down from 7.8 million the previous month

- The 10th consecutive month job openings were below 8 million

- The number of job openings decreased in accommodation and food services (-308,000), health care and social assistance (-244,000), and finance and insurance (-142,000)

- The number of job openings increased in retail trade (+190,000), information (+67,000), and state and local government education (+61,000)

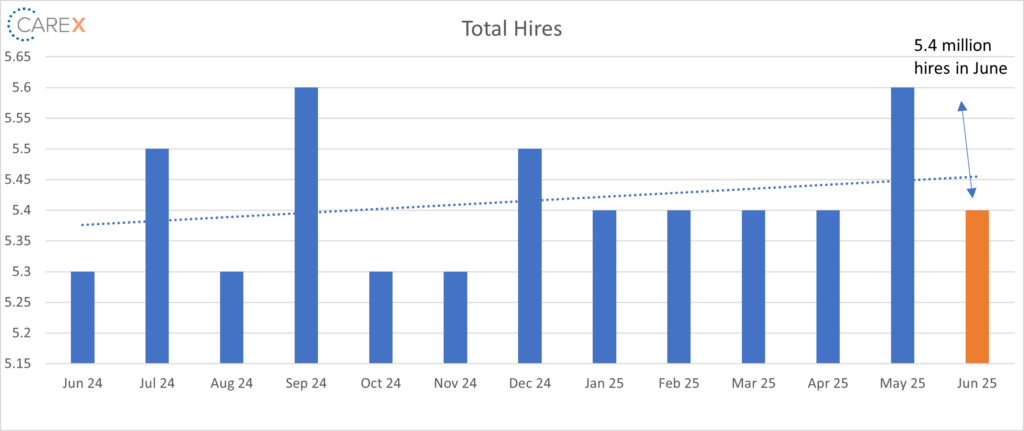

- Hires fell to 5.4 million, down from 5.6 million the previous month

- Not surprisingly, the number of hires decreased in federal government (-10,000)

- The hiring rate remains stuck at levels last seen in 2014, when the U.S. economy was still emerging from the Great Recession

- Layoffs remain unchanged at 1.6 million

-

- The layoff rate remains very low by historical standards

- Quits fell to 3.1 million, down from 3.3 million the previous month

- Quits, which are seen as a measure of worker confidence in the ability to change jobs and find another one continues to remain very steady – and very low

- The number of quits was little changed across all industries

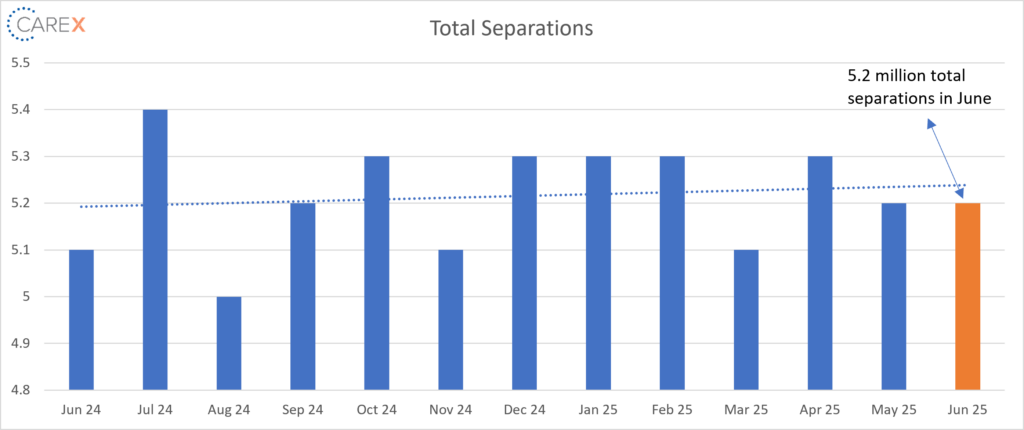

- Total separations remained unchanged at 5.2 million

- The total separations rate remained mostly unchanged for six months in a row at 3.3 percent

- Jobs per available worker remained steady 1.1:1

- At its peak in 2022, the ratio was 2:1

- LFPR (labor force participation rate) dropped to 62.2% down from 62.4%

- The lowest rate since November 2022

- It hit a high of 67.3% in early 2000 and fell to 63.3% in the month before the onset of the pandemic

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email! While you’re here, make sure to check out the other resources we have available.