Now, here’s our labor market insights for October 2025, written by Matt Duffy (prepared without the use of AI):

Key Takeaways:

Due to the Government shutdown, we are unable to provide an updated/accurate Labor Market Index score.

The first Friday of each month is usually “jobs Friday,” when the Bureau of Labor Statistics (BLS) releases its monthly employment report, a cornerstone for understanding the health of the U.S. labor market. But this month, September’s report is missing due to the federal government shutdown, leaving economists, policymakers, businesses – and labor market nerds like me – searching for clarity through alternative data sources. Thanks to the government shutdown, we’re left squinting through private data like we’re trying to read fine print in a fogged-up mirror.

The problem is that private data is like tasting side dishes without the main course. Everything else – state reports, private surveys, forecasts – usually orbits around the BLS numbers. Without them, we’re flying blind. While I appreciate private entities attempting to make sense of the noise, it grades out like my ability on the basketball court – A+ for effort, C- for results.

So, what do these inadequate substitutes say? Well, it’s a mixed bag:

- ADP says we lost 32,000 private-sector jobs in September. Economists were expecting a gain, so that’s a nasty plot twist.

- Challenger, Gray & Christmas reports that hiring plans are down 58% from last year (seasonal jobs especially). Retailers apparently think holiday shopping is going to be more “meh” than “merry.”

- Revelio Labs offers a glimmer of hope, estimating about 60,000 jobs added. Not terrible, but not exactly a party either.

And the longer the shutdown drags on, the more we’ll miss: unemployment figures, inflation data, job openings, wage growth. In other words, all the stuff policymakers and businesses rely on to keep the economic machine humming.

So where does that leave us? Somewhere between “slightly worse than August” and “let’s not even guess.” The labor market has been fragile for months, and if a wave of furloughed federal workers all hit the job market at once, things could get messy fast.

Outside of job creation and unemployment, my “By the Numbers” analysis is thankfully updated (the JOLTS report was released the day before the shutdown).

By the numbers:

- New Jobs – due to the Government shutdown, we won’t be getting the September jobs report this month.

- Unemployment – updated unemployment numbers are not available due to the Government shutdown. As of August, the unemployment rate was 4.3%.

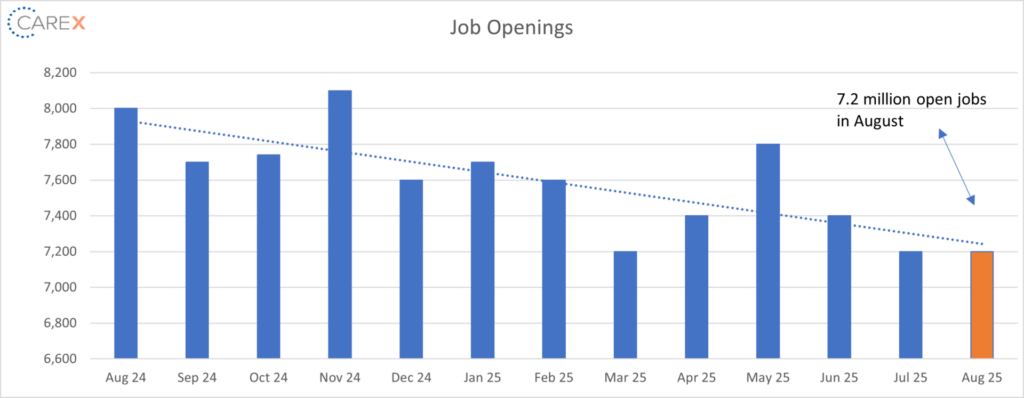

- Job openings remained steady at 7.2 million, down from 7.4 million two months ago

- The 12th consecutive month job openings were below 8 million

- The number of job openings decreased in construction (-115,000) and in federal government(-61,000)

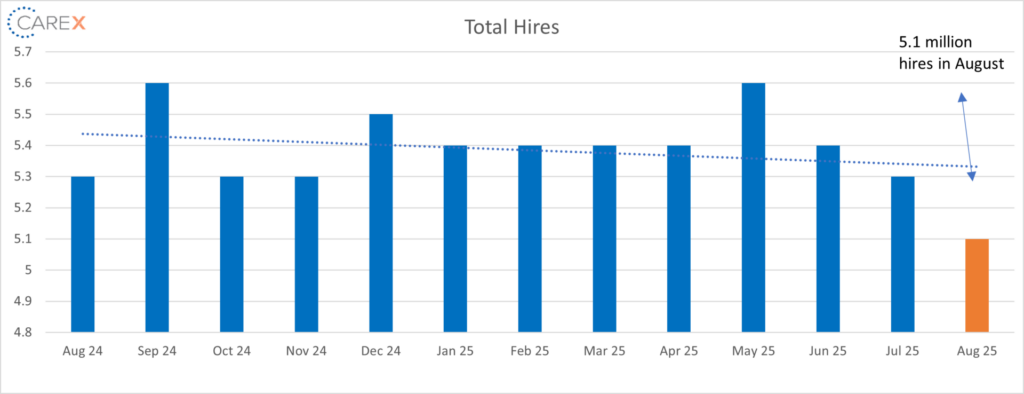

- Hires fell (again) to 5.1 million, down from 5.3 million the previous month

- The hiring rate remains stuck at levels last seen in 2013, when the U.S. economy was still emerging from the Great Recession

- Layoffs decreased to 1.7 million, down from 1.8 million the previous month

-

- While we’re seeing a steady increase in layoff’s, the total layoff rate remains very low by historical standards

- Quits fell slightly to 3.1 million, down from 3.2 million the previous month

- Quits, which are seen as a measure of worker confidence in the ability to change jobs and find another one continues to remain very steady – and very low

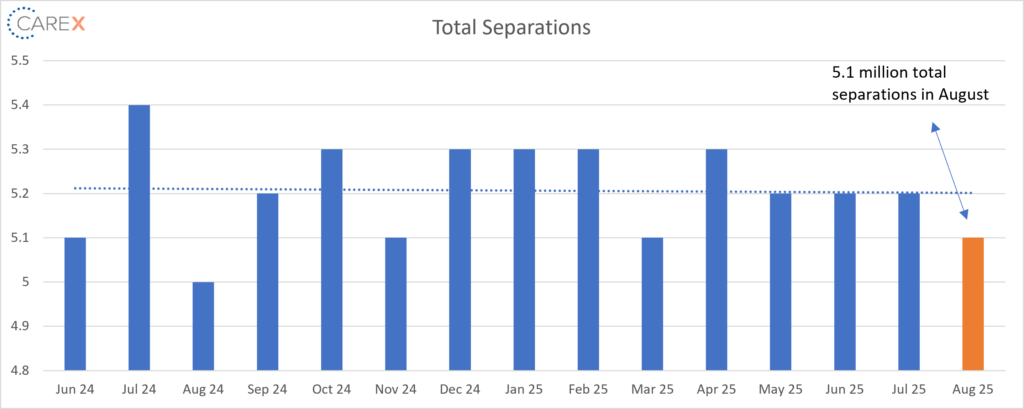

- Total separations dropped slightly to 5.1 million, down from 5.2 million the previous month

- Jobs per available worker sits at1:1

- At its peak in 2022, the ratio was 2:1

- LFPR (labor force participation rate) held steady at 62.3%

- It hit a high of 67.3% in early 2000 and fell to 63.3% in the month before the onset of the pandemic

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email! While you’re here, make sure to check out the other resources we have available.