The BLS and JOLTS report was just released! Below is an overview of the key data points and our summary of the state of the labor market for August 2023.

Key Takeaways:

Most headlines will state that this month’s report signifies a “cooling” of the labor market. I don’t think “cooling” is the right adjective—I think it’s more of a stabilization. We’re seeing a gradual decline in job openings and layoffs—these are notable data points we like to see moving in parallel, as it signifies stabilization (our word for this month!).

Since 2021, when inflation started to rear its ugly head, good news has actually been bad news (“dogs and cats living together! Mass hysteria!” Apologies, I’m a sucker for a good Ghostbusters movie reference). An overly strong labor market/job report evoked an aggressive response from the Federal Reserve (read: rate hikes). However, recently, good news is actually starting to feel like good news. The Fed is slowing its roll, job numbers are still ok (albeit not as strong as a year ago), and layoffs have stabilized.

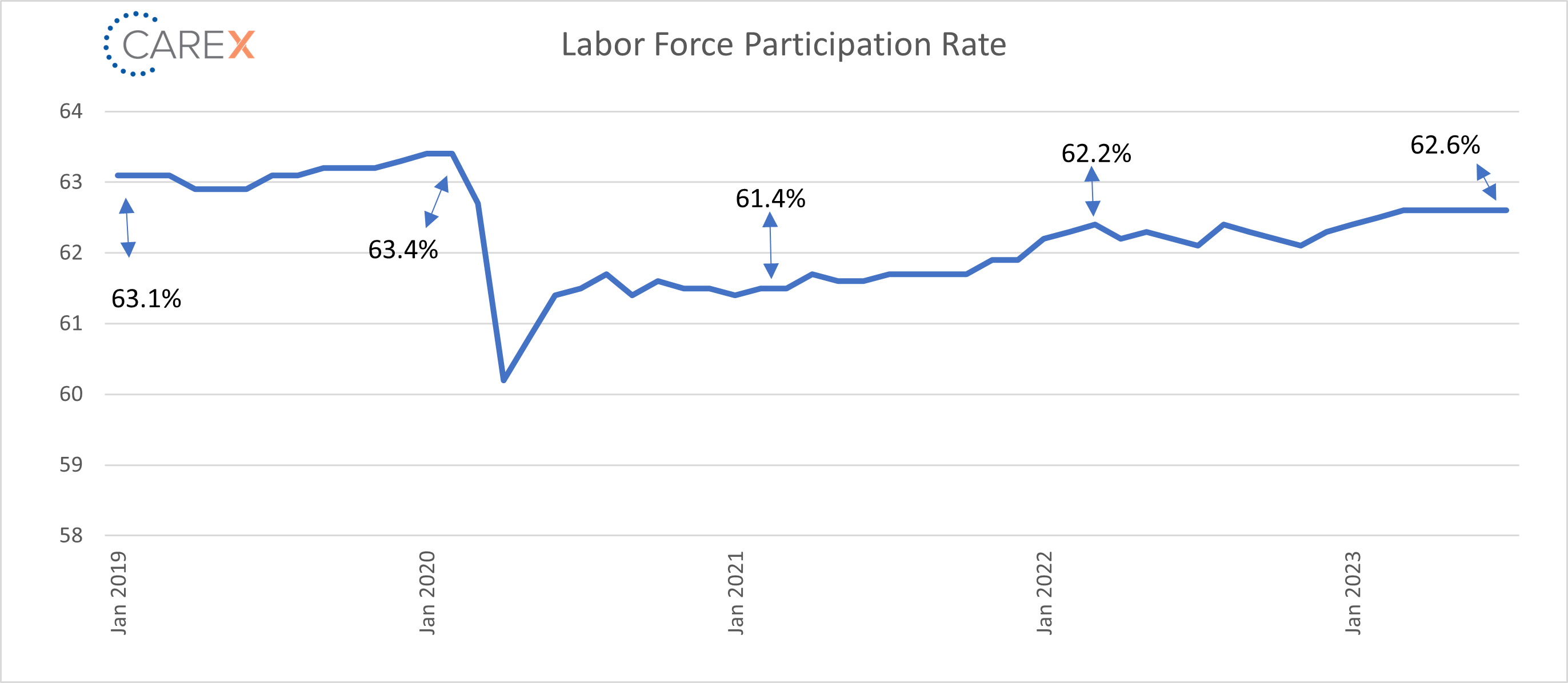

The Labor Force Participation Rate (LFPR) offers another example of stabilization. When the LFPR rises, it means more people are coming into the labor force and easing the wage pressures. However, when the rate falls, it plays a role in job gains that continue to defy expectations, particularly amid a series of Fed rate hikes. Over the past five months, the LFPR remains the exact same—stabilized.

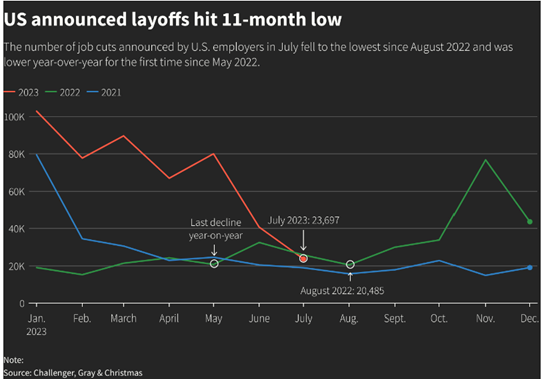

Aside from the broader economic impacts of layoffs, layoffs—from a human lens—always make me cringe (understanding the personal impact of those affected). Layoffs have stabilized in a big way; a recent report/graph by Challenger, Gray & Christmas shows the incredible impact—and stabilization—of layoffs this year.

By the Numbers:

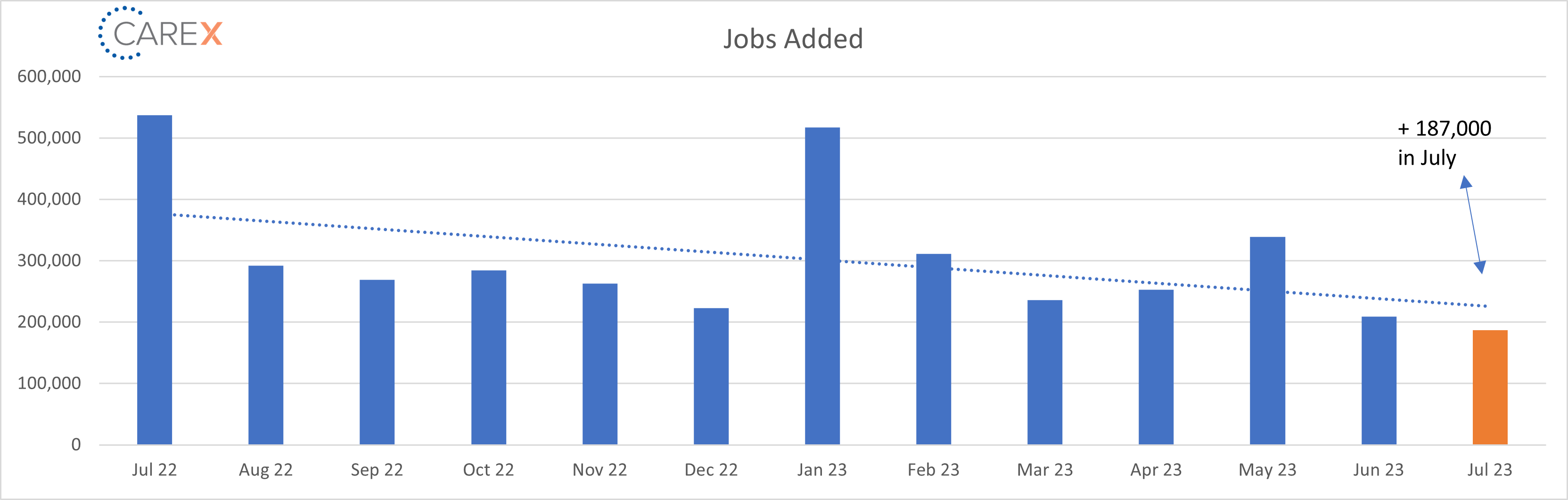

- New Jobs – The U.S. added 187,000 new jobs last month, a decrease from last month’s addition of 209,000 new jobs [chart above].

- It was the lowest monthly gain since a decline in December 2020.

- Small businesses continue to bolster the job count, counter-balancing large companies who controlled hiring this time last year.

- Unemployment dropped to 3.5%, down from 3.6% from the previous month.

- Remaining in the historically low range, where it has now been since spring 2022.

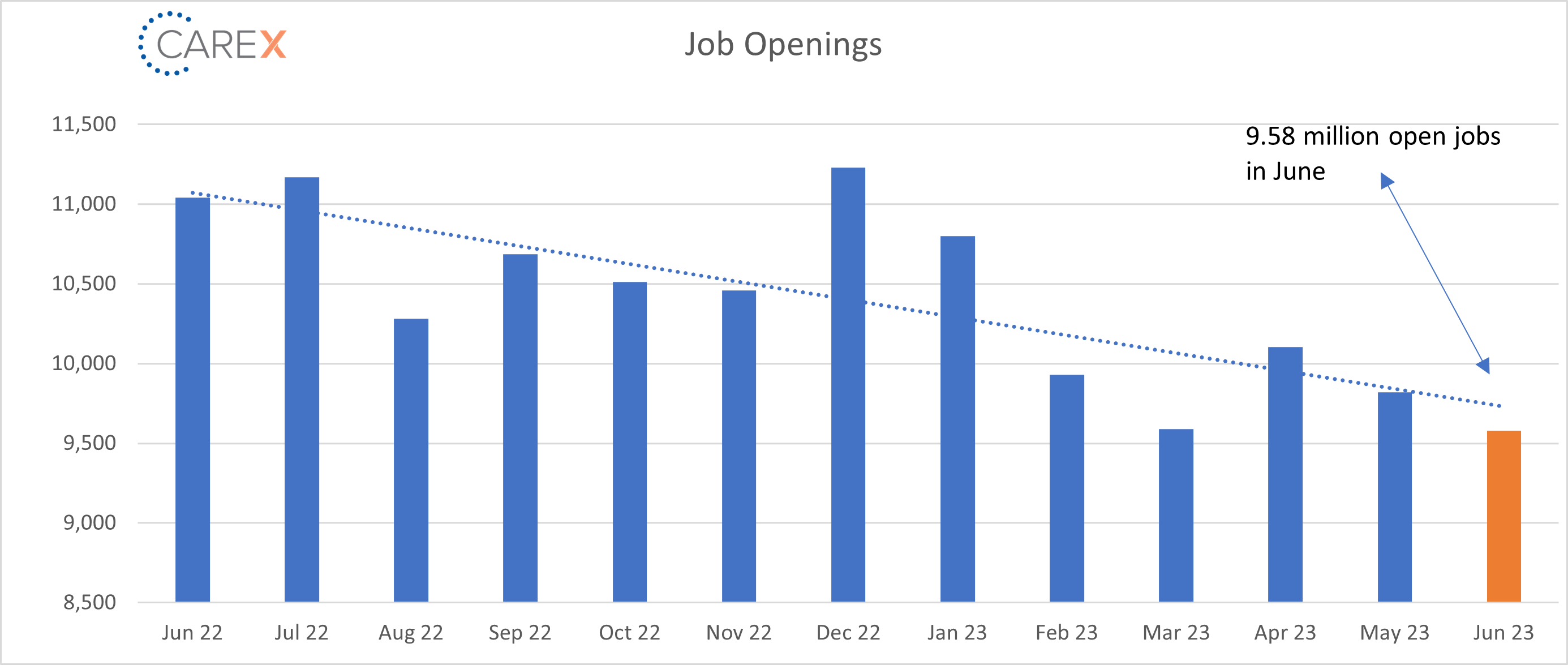

- Job openings fell to 9.58 million, a drop from 9.82 million the previous month, and 10.1 million two months ago [chart above].

- Openings continue to drop from their 12 million peak in March of last year.

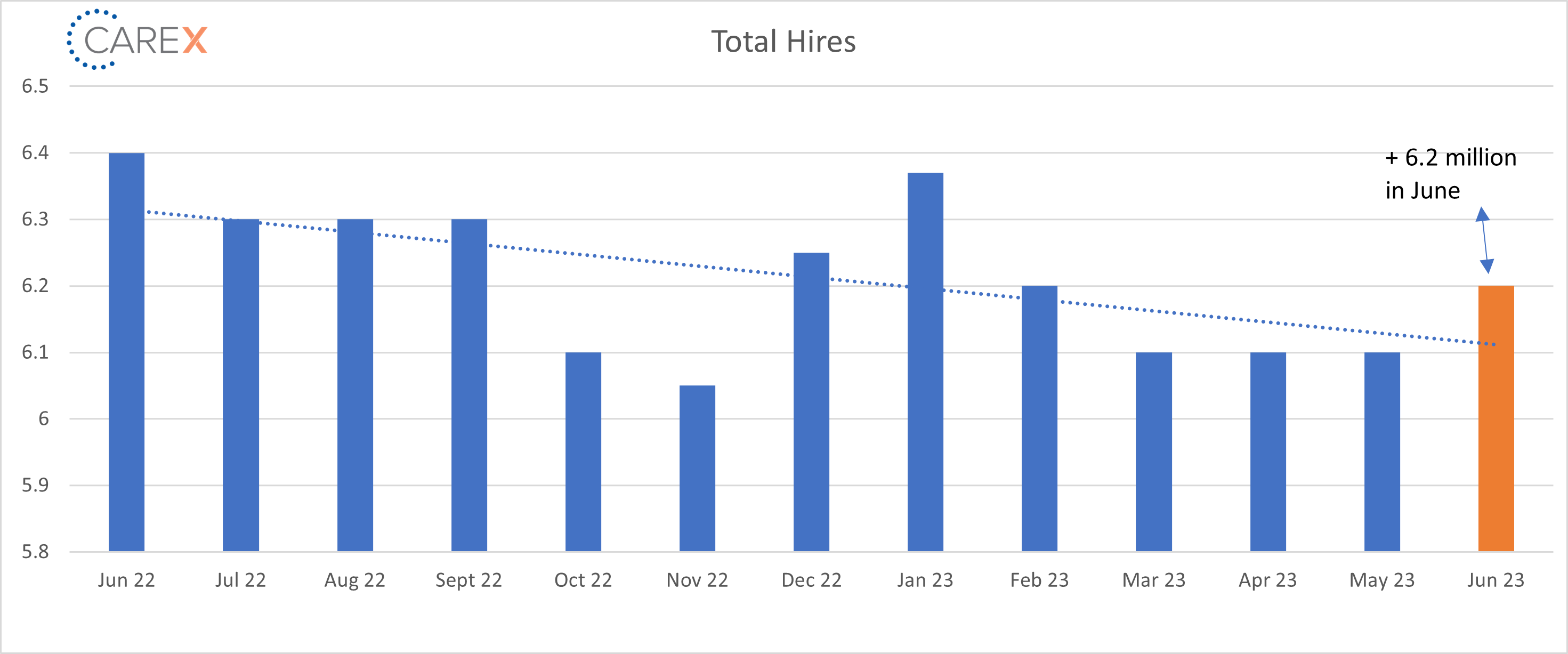

- Hires remain largely unchanged at 6.2 million, with a slight increase from last month at 6.1 million [chart above].

- Hires have remained steady over the past year, ranging from 6.1 to 6.3 million during that time frame.

- It’s likely this number will continue to edge down as job openings and new jobs created start to normalize.

- Layoffs dipped to 1.53 million, down from 1.56 million last month, and down from 1.59 million two months ago.

- Quits – The number of people quitting their job dropped to 3.8 million, a decrease from 4 million the previous month.

- Further signifying the market is stabilizing (in other words, workers are less confident that the grass is greener on the other side).

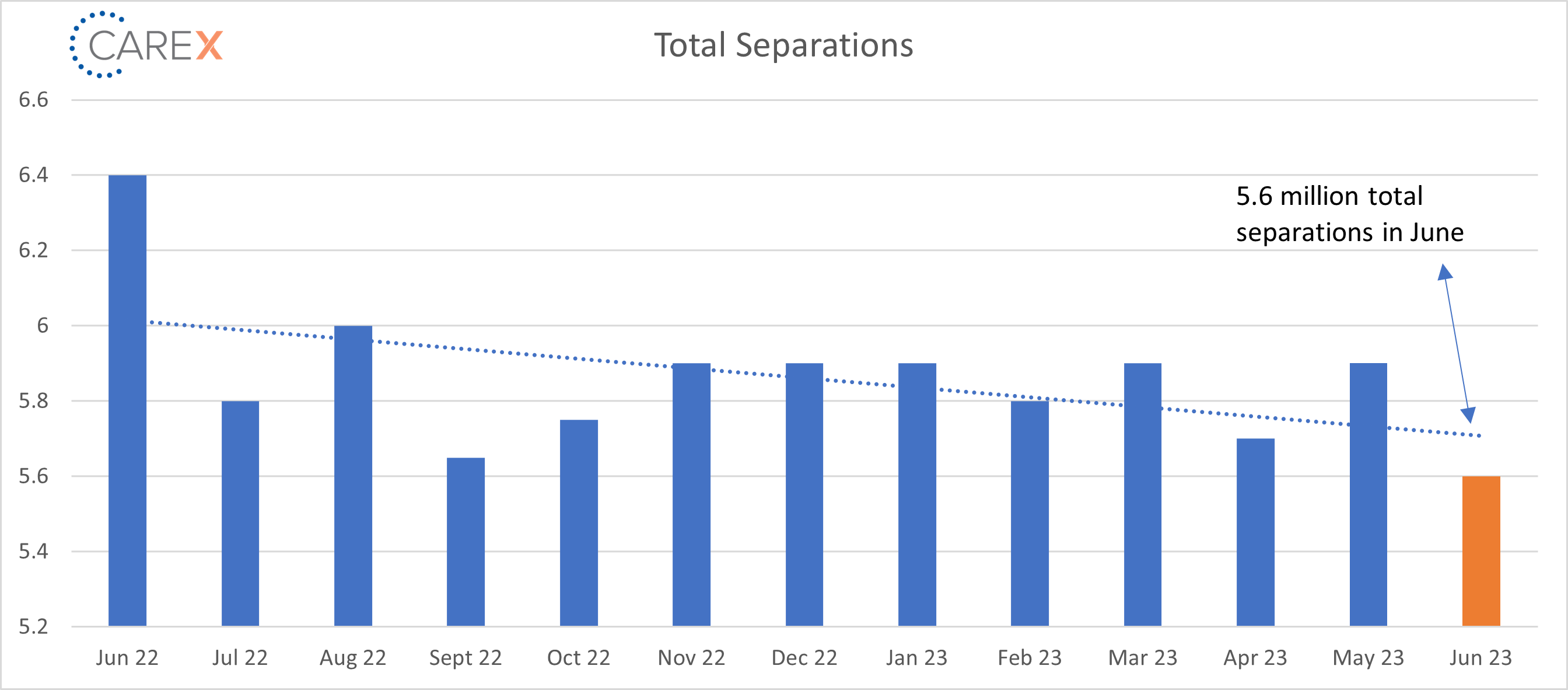

- Total separations fell to 5.6 million, a drop from 5.9 million the previous month [chart above].

- Jobs per available worker remained unchanged at 1.6:1, down from 1.8:1 two months ago.

- Four months ago, the ratio was 1.9:1 (and averaged ~2:1 over the past 2 years).

- Pre-pandemic this number was ~1.2:1.

- Labor Force Participation Rate (LFPR) held steady at 62.6%.

- The 5th straight month at that level.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive these updates via email here! And while you’re here, make sure to check out the other resources we have available.