The recent JOLTS and BLS reports show the continued resiliency of the labor market. Demand for employment remained high in November, as companies looked for workers to fill positions despite worries of a looming recession. Following are a few key data points and view of the pertinent takeaways for January 2023.

Relevant Data Points:

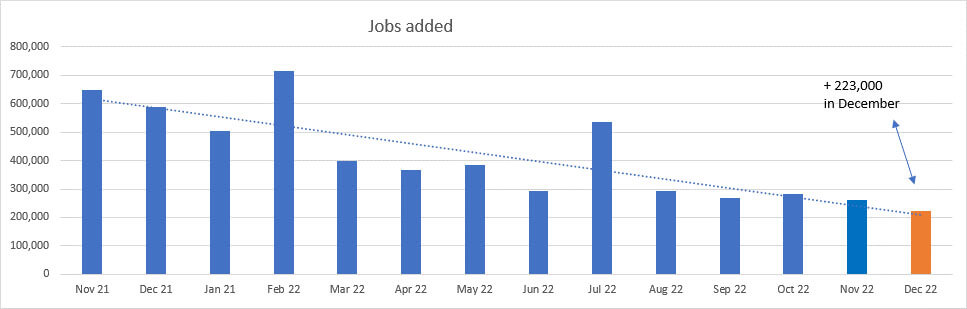

- New Jobs – The U.S. added 223,000 new jobs (chart below)

- This was generally in line with expectations but lower than the average in recent months.

- Unemployment fell to 3.5% (previously 3.7%), back to its low point since the pandemic.

- Wages – Average hourly earnings increased 0.3% for the month, and 4.6% annually.

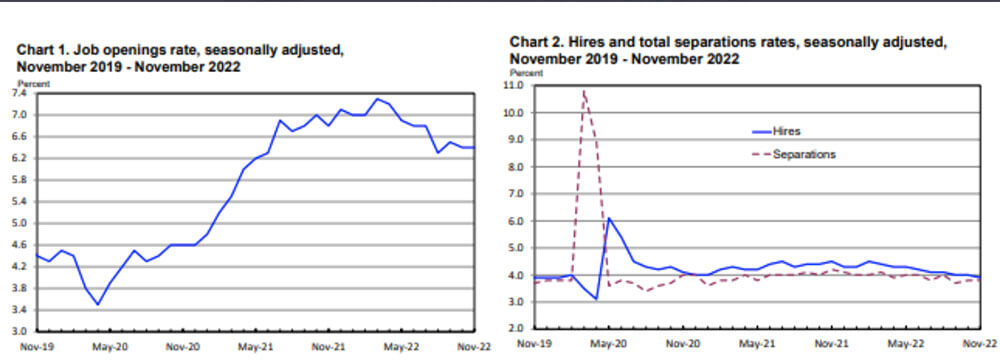

- Job openings totaled 10.46 million, largely unchanged from the previous month, but above the forecasted number of 10 million (chart below).

- As a share of the labor force, job openings remained at 6.4%, indicating demand for workers is still high despite the Fed’s efforts to cool the economy and bring down inflation, which has been partially driven by rising wages.

- Hires dropped slightly to 6.05 million (6.1 the previous month) (chart below).

- Layoffs – The number of layoffs and discharges changed little at ~1.4 million, and the rate remained at 0.9%.

- However, the latest job cuts report from Challenger, Gray & Christmas also showed “tech companies led announced layoffs for all of 2022, with 97,171 job cuts expected, a whopping 649% surge from 2021.”

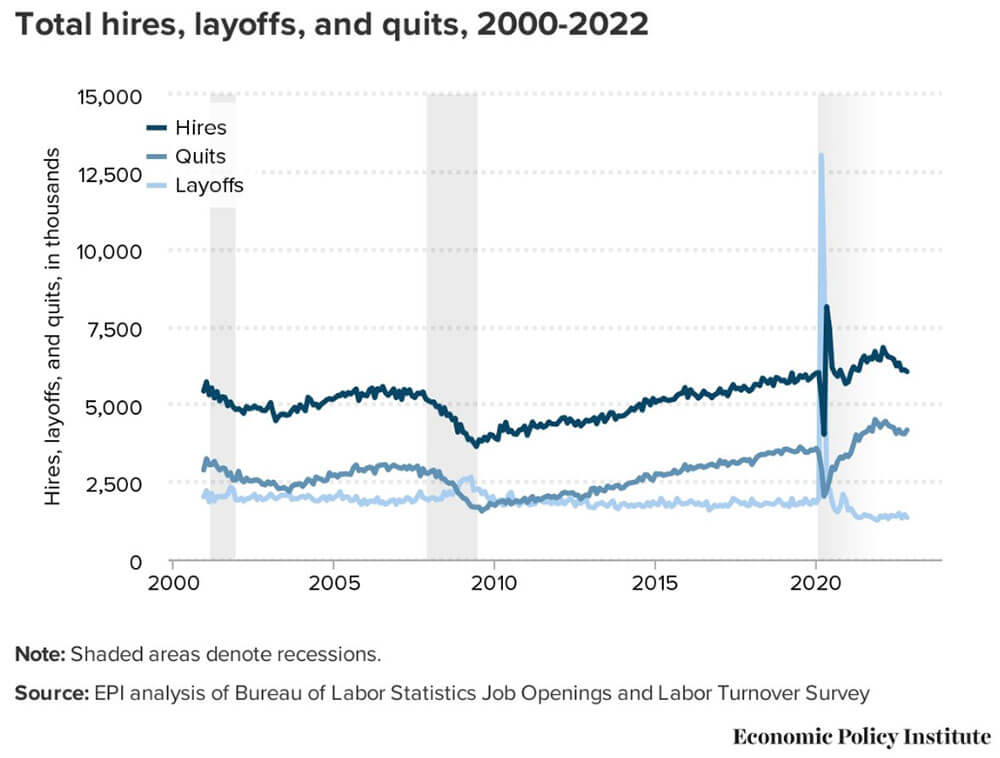

- Quits – The number of people quitting their jobs increased to 4.17 million (4.05 million the previous month).

- The quit rate has been above 4 million for 18 straight months, after coming in at 3.4 million before the pandemic and averaging 2.6 million in the prior years.

- The quit rate is a measure of worker confidence that they can easily move from one job to another.

- Total separations nudged higher to 5.9 million (previously 5.7 million) (chart below).

- Jobs per available worker remained largely unchanged, with open positions outnumbering available workers by about 1.7:1.

- Fed officials have been watching this ratio closely, since tightness in the labor market means employees have greater leverage to seek higher wages, which in turn drives up inflation.

- LFPR (labor force participation rate) increased for the first time in four months, ticking up to 62.3%. The LFPR is a pivotal data point, as it generally measures the number of people participating in (either working or actively looking) the labor market. A continual depression of the LFPR often exacerbates a tight labor market (as a point of reference, the LFPR was 63.1% in January of 2019).

What does this mean?

- This month’s data shows a slight decrease in hiring and a bit of an increase in layoffs. On the flip side, the data shows little indication of substantial labor market softening. However, the continued decline in job creation is a sign that the Fed’s strategy to quell inflation may finally be constraining the labor market.

- With all the uncertainty (confusion) surrounding the labor market, we feel the quit rate/trend is the most telling data point. To understand the true pulse of the labor market, the activity of the people in the market is often most telling. People continue to feel extremely confident about their opportunities and continue to quit at historic rates.

- In contrast to what we see on LinkedIn and other news/social media sources, there was no increase in layoffs reported; in fact, layoffs dropped a bit between October and November.

- While the data continues to support a healthy labor market, a quick synopsis of the labor market can be gleaned by looking at the red and blue lines in Chart 2: Hires and total separations rates (above). At the most basic level, as the red line approaches the blue line, we should take a tempered approach to our enthusiasm. Our enthusiasm in the labor market is typically, in part, measured by the degree of separation of those two lines.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email here! While you’re here, make sure to check out the other resources we have available.