New job reports were just released! Here’s our labor market insights for January 2024.

Key Takeaways:

I love data. It turns opinions into facts. And while we tend to spin data to fit our own narrative, data is factual. Through 2023, the US recorded a net gain of nearly 2.7 million jobs. That’s great, right?! True, but it’s just about half of the 4.79 million jobs gained in 2022. That’s bad, right?! Well, 2022 represented the second-highest annual total gains on records going back to the WWII era, so it’s a tough comparison.

Not only does data paint a picture of what happened, it often tells us what will/might happen in the future. This is the time of year when I write my annual “labor market predictions.” However, this year I’m taking the 5th—I refuse to answer the “what will happen in 2024″ question on the grounds it may incriminate me. If I can be honest, I truly don’t know (and I always think I know!). There are just too many variables as we kick off the new year—global uncertainty, a truly bizarre election cycle, lack of clarity with recent BLS trends, and the Fed continuing to play peek-a-boo with interest rates and unemployment, etc. I’m neither smart enough to read the data tea leaves, nor arrogant enough to think my predictions will be accurate. Oddly enough, if I were forced to pen a prediction, it would mirror my thoughts I shared last year when I wrote WTF is happening with the Labor Market, a Possible Recession, and Unemployment? (in summary: the Beveridge curve, hire/quit data, and the LFPR signify we’ll avoid a recession and stick the soft landing).

In lieu of making a 2024 prediction, I’ll share a few themes that are emerging in the labor market. Over the past several months, I’ve spoken with several employees/leaders (spanning several industries and geographies) about various workforce planning needs/trends on their radar. Three very clear trends emerged from these discussions:

1. “We’ve been asked to do more with less.”

The Problem: 2023 represented a year of significant uncertainty, most notably the concern about a possible recession. With this lingering uncertainty, many important budget/staffing initiatives were left unaddressed.

The Result: Companies were hesitant to add staff (FTE and/or Contractors), leaving existing staff responsible for carrying the weight of the various initiatives in flight—thus the feeling of “we’ve been asked to do more with less.”

Analysis: The cloud of uncertainty seems to be lifting (albeit slightly), which may push leaders to advance growth initiatives in the queue, resulting in an advance of hiring staff (FTE and/or Contractors).

2. We’ve officially shifted from the “Great Resignation” to the “Great Stay.”

The Problem: Coming out of the Pandemic, we saw a historical shift in the employment landscape. New jobs skyrocketed (as noted above, we added nearly 5 million jobs in 2022), and wage inflation opened the door for a massive number of people to change jobs.

The Result: While the grass was greener in terms of compensation, many regretted the decision to leave (further reinforcing that money can’t buy happiness). Shortly after the “great resignation,” the labor landscape changed and the opportunity to change jobs again shifted. Those that did change jobs reported less willingness to leave again, not wanting to tempt fate of a recession impeding their ability to find another job.

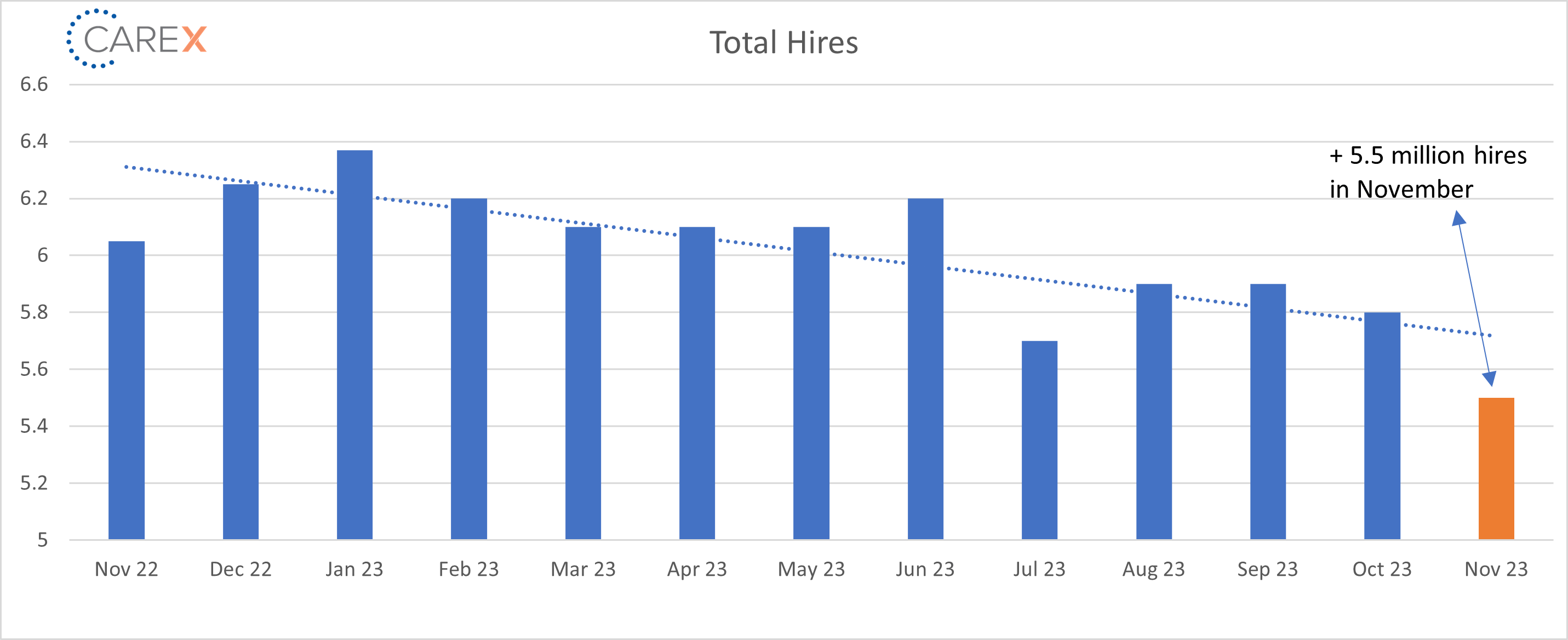

Analysis: It’s going to be much harder to lure employees to leave their job, and companies will be inclined to hold on to their existing employees (of all the BLS data, the hire, quit, and layoff data support this trend/prediction).

3. Leaders need to be unapologetically intolerant of a*sholes in the workplace.

The Problem: While we collectively have gotten better about addressing toxic workplace behavior, bad behavior—particularly by managers/leaders—has gone unchecked.

The Result: In today’s remote/hybrid and highly connected workplace culture (where many of us are on, even when we’re off), our work/life balance is critical. As a society, we’re getting better about acknowledging the importance of mental health. Recent employee engagement surveys/data spotlight the importance of a healthy/trusting workplace with recruitment and retention efforts.

Analysis: Recruiting and retention continue to be one of the few items most (if not all) leaders struggle with, and they’re often at the top of the key strategic issues impacting company growth. Being a good human will tip the scales in a company’s ability to attract/retain the best talent. In a world of online reviews, toxic cultures will be exposed and will no longer attract the top (or even average) talent.

By the Numbers:

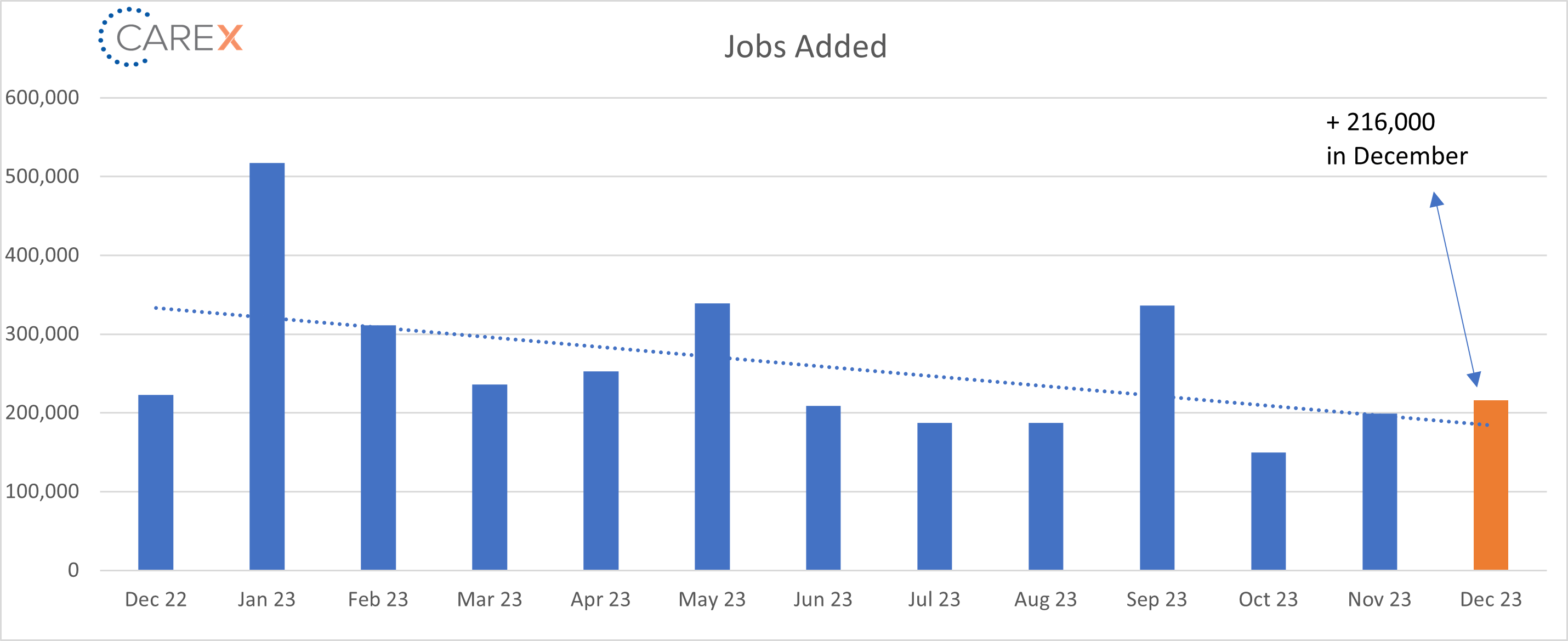

- New Jobs – The U.S. added 216,000 new jobs in December, a surprising uptick from 199,000 new jobs created the previous month.

- Employment continued to trend up in government, health care, social assistance, and construction.

- Transportation and warehousing were the most notable losers.

- Economists were expecting net job gains of 160,000 for December.

- Through December, the economy has added an average of ~233,000 jobs per month.

- Unemployment remains unchanged at 3.7%.

- Economists were predicting unemployment at 3.8%.

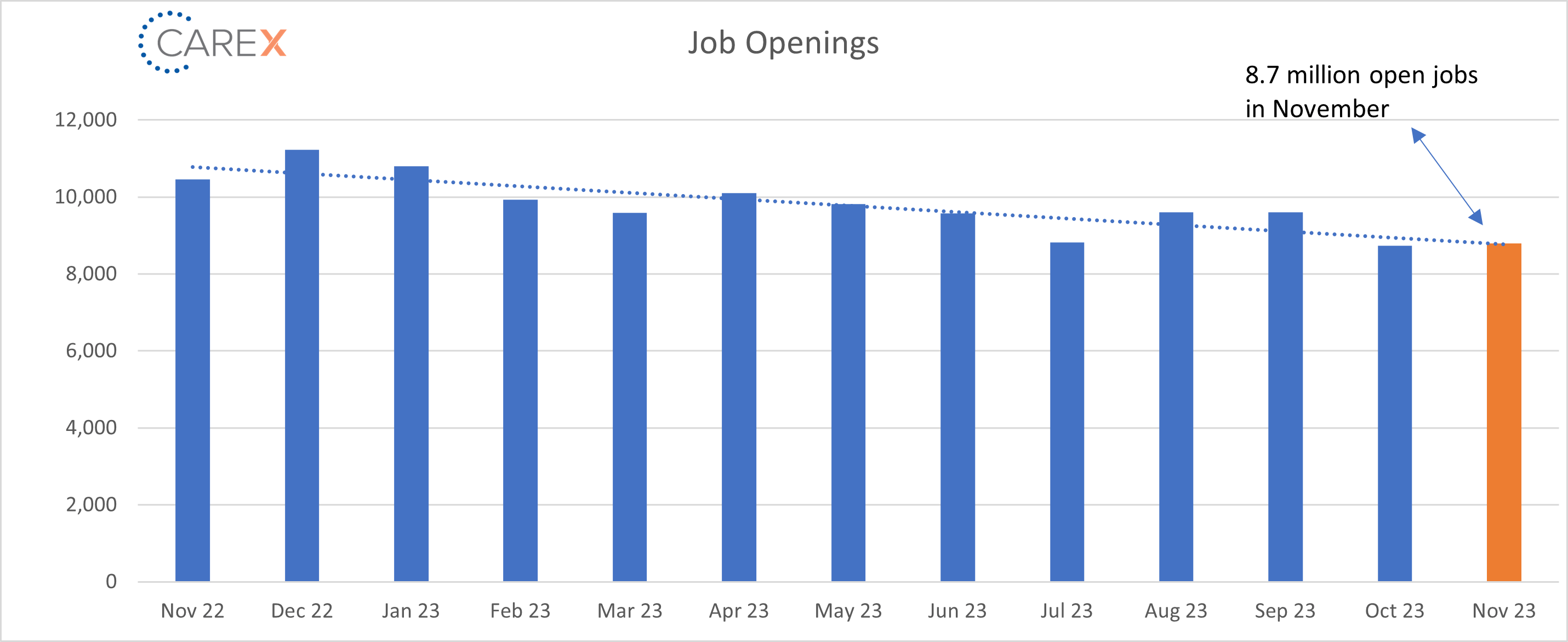

- Job openings remain largely unchanged at 8.79 million, down slightly from 8.85 million the previous month.

- A decrease of 128,000 for transportation, warehousing and utilities and were off 97,000 in leisure and hospitality.

- Wholesale trade saw an increase of 63,000 and financial activities grew by 38,000.

- ~23% more openings than before the pandemic.

- Hires decreased to 5.5 million, down from 5.8 million the previous month, and still lower from 5.9 million two months ago (chart above).

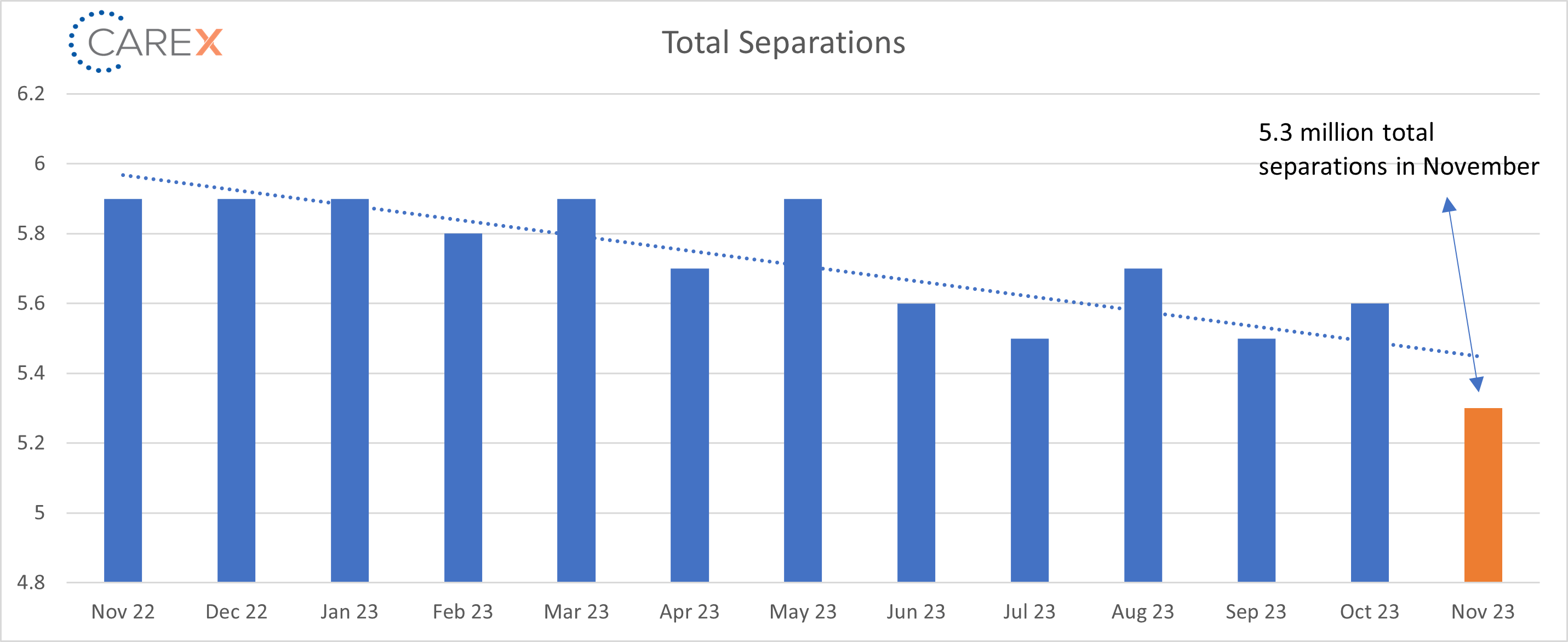

- Layoffs continue to decrease with 1.5 million this month, down from 1.6 million last month, and 1.7 million three months ago.

- The number of layoffs remain very low by historical standards.

- Quits fell to 3.5 million, down from 3.6 million last month, and 3.7 million two months ago.

- Quits, which are seen as a measure of worker confidence in the ability to change jobs and find another one continues to remain very steady (and very low).

- The quit rate had peaked around 3% of total employment in late 2021 into early 2022, during what briefly was known as the Great Resignation as workers left their old jobs in search of positions that paid more and offered better working conditions; it since has declined to 2.3%.

- Total separations fell to 5.3 million, down from 5.6 million last month, with a notable continual decline of 5.5 million two months ago, and 5.7 million three months ago.

- Jobs per available worker fell to 1.4:1, down from 1.3:1 the previous month.

- This ratio averaged ~2:1 over the past 2 years.

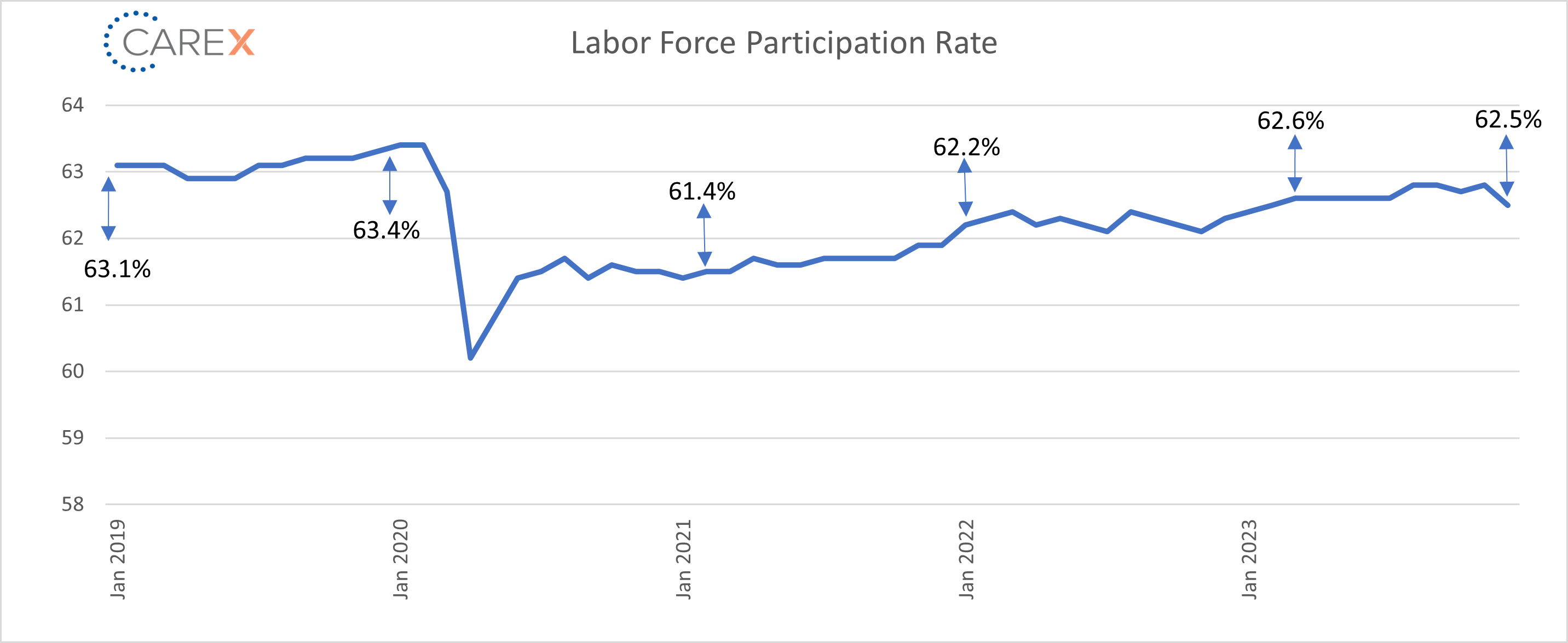

- Labor Force Participation Rate (LFPR) dropped to 62.5%, down from 62.8% last month.

- A shrinking labor force could increase pressure on employers to raise wages and push up inflation.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email here! While you’re here, make sure to check out the other resources we have available.