The BLS and JOLTS report was just released! Below is an overview of the key data points and our summary of the state of the labor market for July 2023.

Key Takeaways:

As a child, my favorite playground activity was always the seesaw, constantly going up or down depending on who was on the other side. Just like a seesaw, labor data is constantly in motion—rising up or dipping down. But occasionally, we find balance. This month’s labor report reminds me of that glorious moment where you and your partner are sitting in the middle of the seesaw seeing eye to eye. The numbers continue to flux, but this month’s report—I feel—shows evidence that the labor market is slowly coming into a better balance as job growth slows and the labor supply steadily expands.

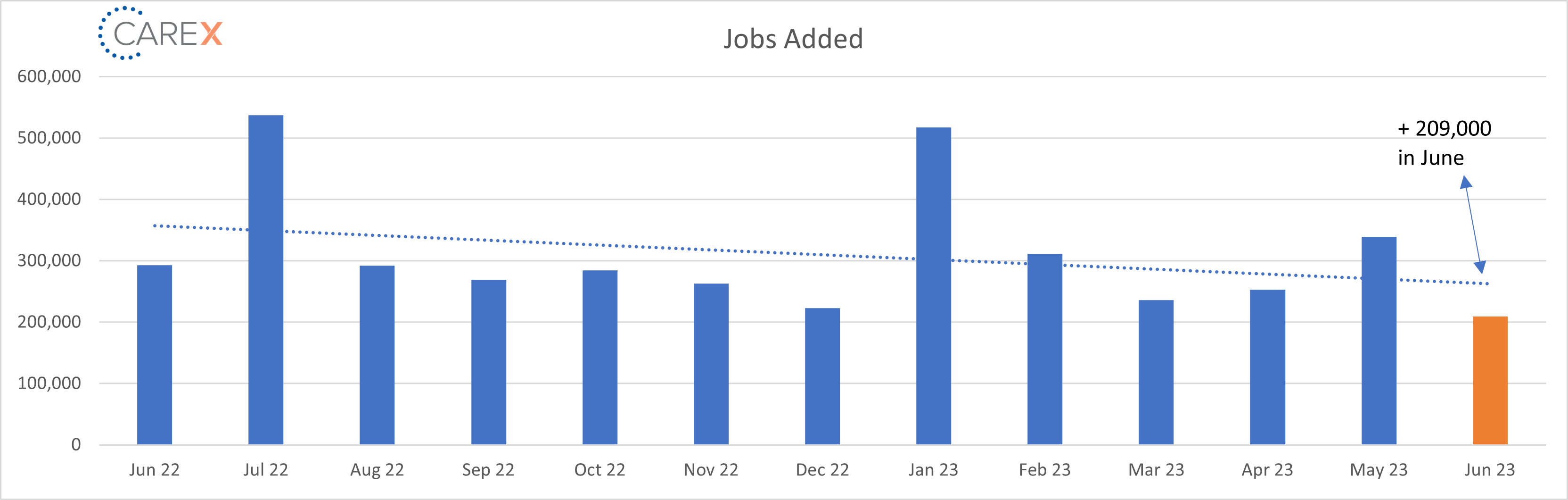

Yes, we only added 209,000 new jobs in June, the slowest pace since 2000. While lower than previous months, this pace would have been considered very healthy pre-COVID (keep in mind that this was the 30th consecutive month of job gains). This brings the six-month average to 278,000,down from an average of 399,000 last year. From my perspective, this isn’t concerning, it’s simply finding balance in a more sustainable manner. Just because a number is noticeably higher or lower than the previous month(s), it doesn’t make it necessarily good or bad—we just might be seeing the pendulum find its way back to the middle ground.

The most common question I receive is asking how job gains continue to increase while the unemployment rate decreases (or remains steady). Steady growth in the labor force participation rate is a significant contributor to this equation. Prime-age (25–54) labor force participation hit its highest rate—83.5%—since May 2002.

By the Numbers:

- New Jobs – The U.S. added 209,000 new jobs last month, a decrease from last month’s addition of 339,000 new jobs (chart above).

- It was the lowest monthly gain since a decline in December 2020.

- Job gains were driven by government (+60,000 jobs added), healthcare (+14,000), social assistance (+24,000), and construction (+23,000).

- Unemployment remained relatively flat at 3.6%, dipping just .1% from the previous month.

- Remaining in the historically low range, where it has now been since spring 2022.

- The number of workers employed part time due to slack work or soft business conditions increased sharply to 6.2 million—the highest level in a year.

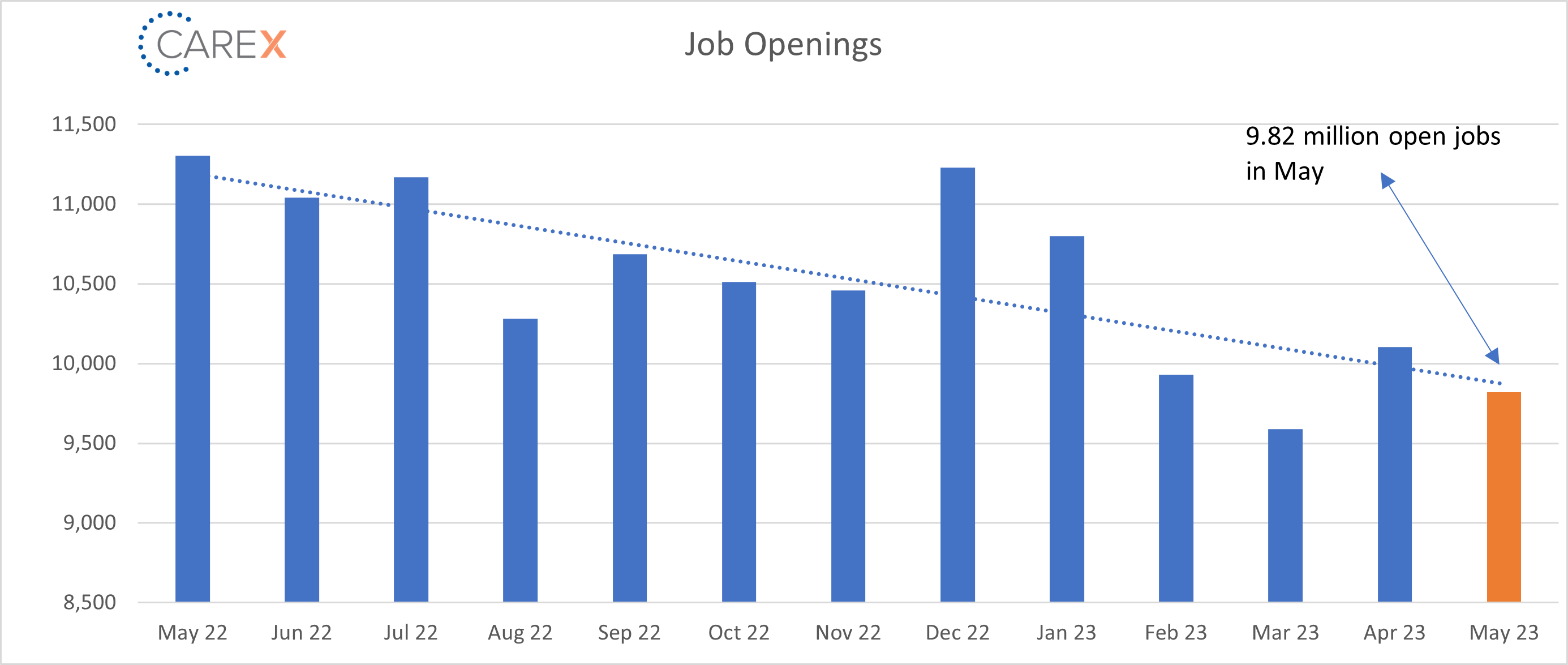

- Job openings fell to 9.82 million, a drop from 10.1 million the previous month (chart above).

- Openings have cooled considerably from their 12 million peak in March of last year.

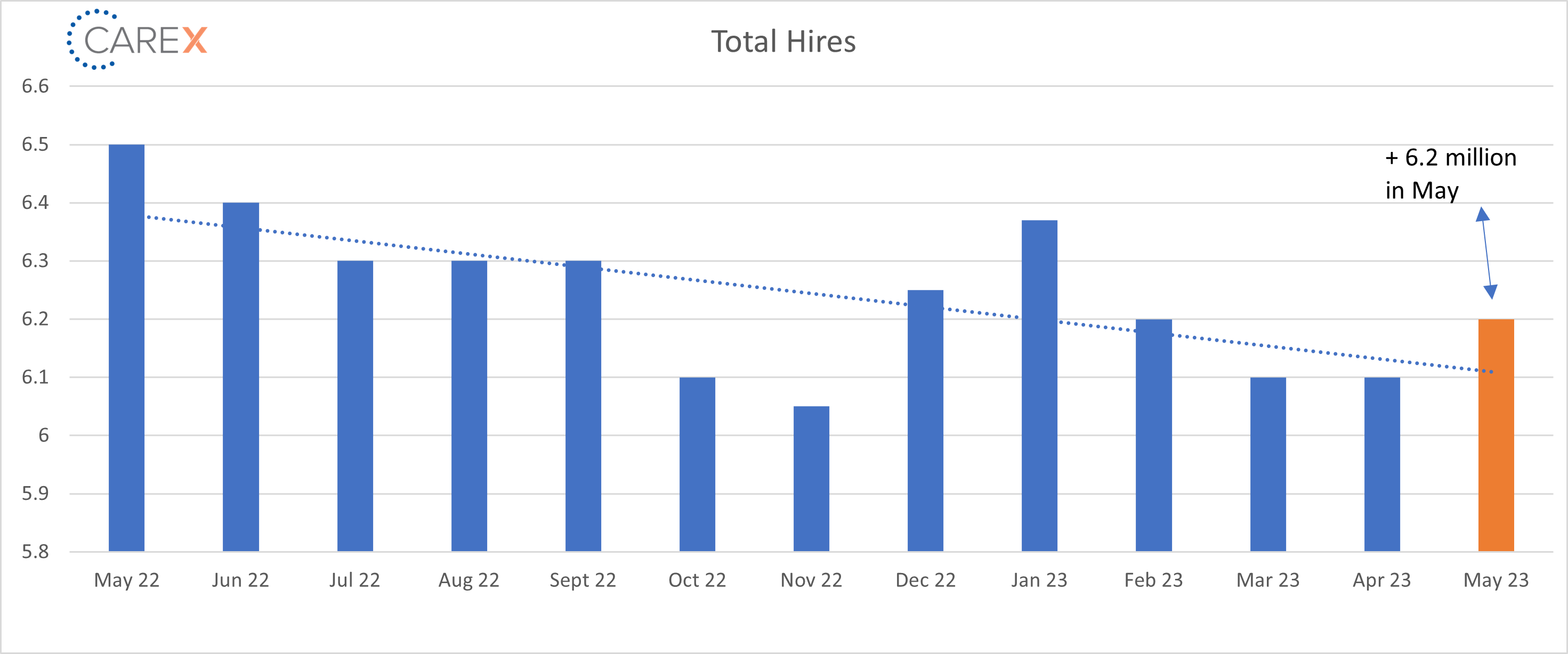

- Hires remain largely unchanged at 6.2 million, with a slight increase from last month at 6.1 million (chart above).

- Hires have remained steady over the past year, ranging from 6.1 to 6.3 million during that time frame.

- It’s likely this number will continue to edge down as job openings and new jobs created start to normalize.

- Layoffs dipped to 1.56 million, down from 1.59 million the previous month.

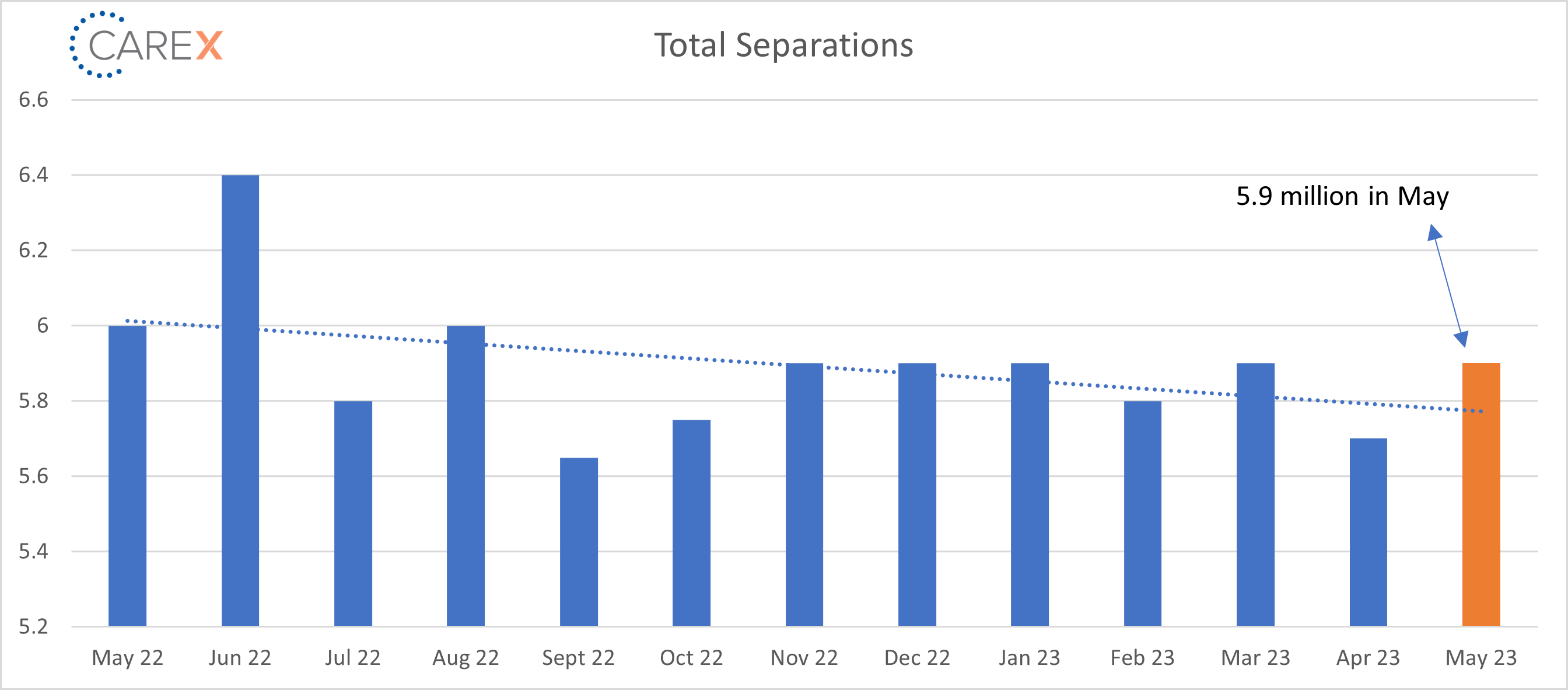

- Quits – The number of people quitting their job jumped to 4 million, up from 3.8 million the previous month.

- With quits popping back up over the 4 million mark for the first time since December, it’s a sign that workers continue to have leverage in the job market.

- Total separations increased slightly to 5.9 million, a slight increase from last month’s 5.7 million (chart above).

- Jobs per available worker decreased to 1.6:1, down from 1.8:1 the previous month.

- Four months ago, the ratio was 1.9:1 (and averaged ~2:1 over the past 2 years).

- Pre-pandemic this number was ~1.2:1.

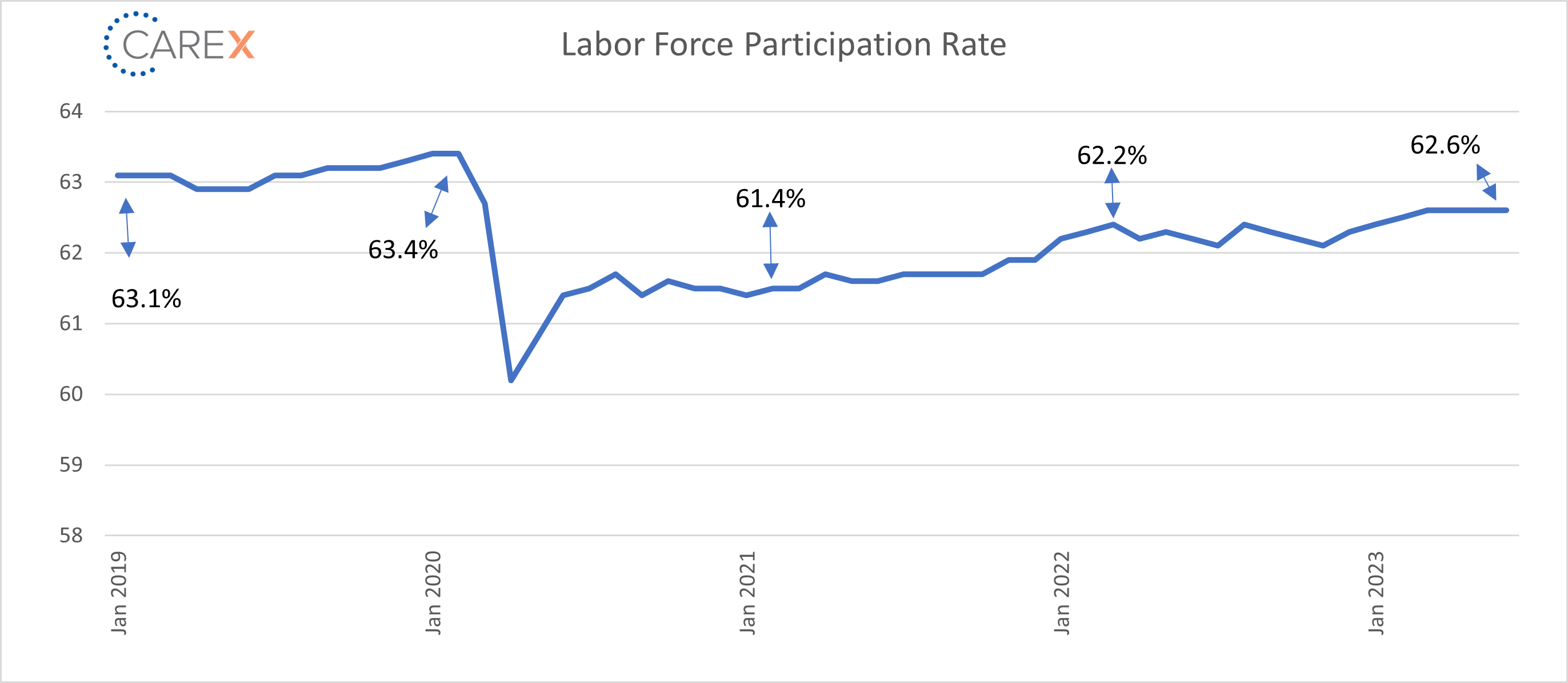

- Labor Force Participation Rate (LFPR) held steady at 62.6%.

- The highest since the pandemic started in early 2020, but still leaves it well below the pre-COVID level of 63.4%.

- The prime-working-age labor force participation rate moved up to 83.5%, matching its highest level since 2002.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive these updates via email here! And while you’re here, make sure to check out the other resources we have available.