New job reports were just released! Here’s our labor market insights for March 2024.

Key Takeaways:

I love March—it’s my favorite month of the year. Two reasons: March Madness (college basketball) and St. Patrick’s Day. But it’s not all about tiny leprechauns sipping whiskey while watching hoops. It’s a month of hope and optimism. It brings us daylight savings; the start of baseball spring training (when every team is a contender); spring break trips; and the hope you won’t receive hundreds of political calls/texts leading up to the election, and that your kids will spend more time outside and less time looking at their phone (the last two might be more blind optimism than realistic hope).

This year, I’m also hopeful/optimistic about the labor market. While there are more than a few question marks, there are a few leading indicators that offer hope. Here are a few hope-inducing data points:

Technology Jobs:

I don’t think any industry/sector/job-type has seen such wild swings as IT has over the past 2 years. The IT sector saw record breaking job gains, hires, and wage spikes in 2021-2022. Just 1 year later, the bottom fell out and we saw record breaking layoffs. Data suggests the “bad” is in the rearview mirror and the pendulum is now swinging the other way. Granted, tech-related job postings are still 25% below pre-pandemic levels; but hiring and talent scarcity in such a critical sector have left many organizations feeling the squeeze, and I forecast (hope) it’s close to rebounding in a big way.

Job Gains:

Job gains have been widespread and largely in sectors that need it most. Comparatively, last year’s gains were quite uneven—~80% of job gains were in just a few industries (Healthcare, Government, and Hospitality). While job gains are still overweighed in a few industries, broad based job gains signify market normalization, which is good for job seekers and companies alike (and gives me hope).

Layoffs:

Remain historically low. Many companies are reluctant to lay off workers after several labor shortages since the pandemic and continual job gains will buoy that sentiment. Unemployment may indeed hit 4+%, but the labor market can (I hope) shoulder that increase without spiraling out of control.

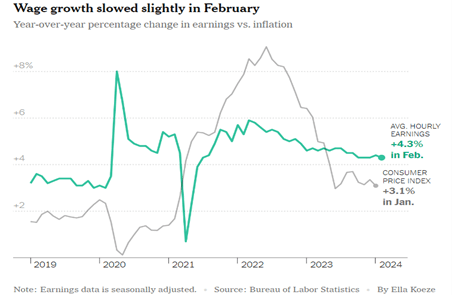

Wage Growth:

Has stabilized. It’s a bit counterintuitive—as workers, we all want our wages to increase; however, we’re seeing that strong job gains don’t automatically trigger wage growth. This balance is necessary to curb interest rate hikes. As it stands, I feel (hope) the Fed will likely cut rates mid-year.

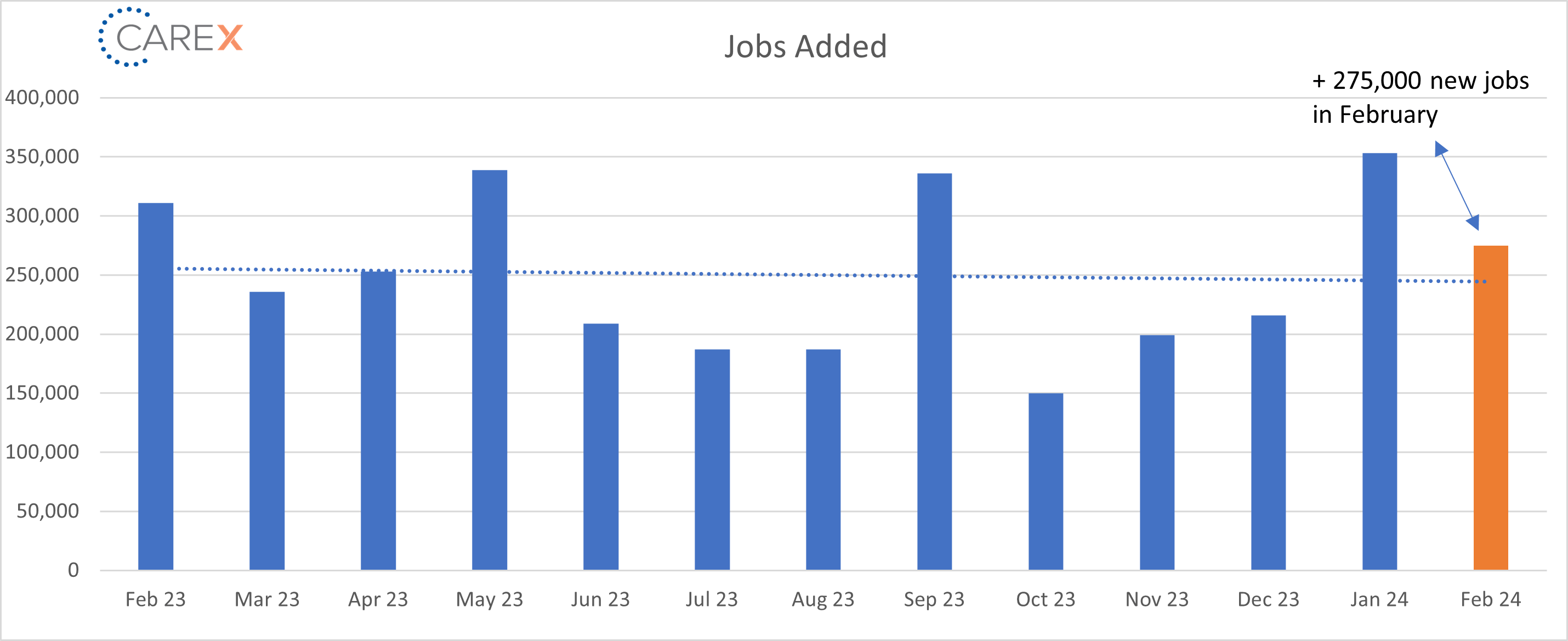

By the Numbers:

- New Jobs – The U.S. added 275,000 new jobs in February, once again beating expectations.

- There were job gains in all but three sectors (Mining & Logging, Wholesale Trade, and Manufacturing).

- Unemployment ticked up to 3.9%, up slightly from 3.7% the previous month.

- The Fed anticipates (hopes) it’ll hit 4.1% by the end of the year.

- It’s been under 4% for 25 months (a record not seen since the 1960s).

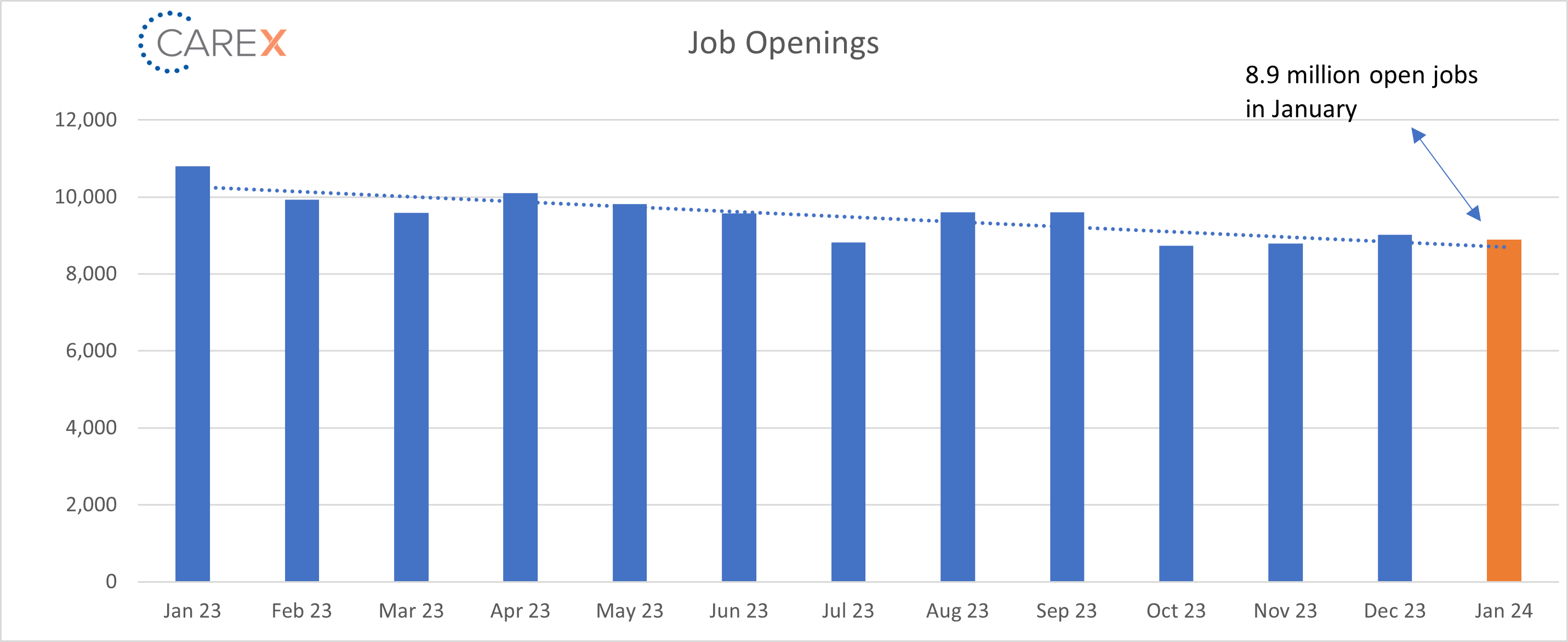

- Job openings fell to 8.9 million, down from 9.02 million the previous month.

- Job openings peaked at a record 12.0 million in March 2022.

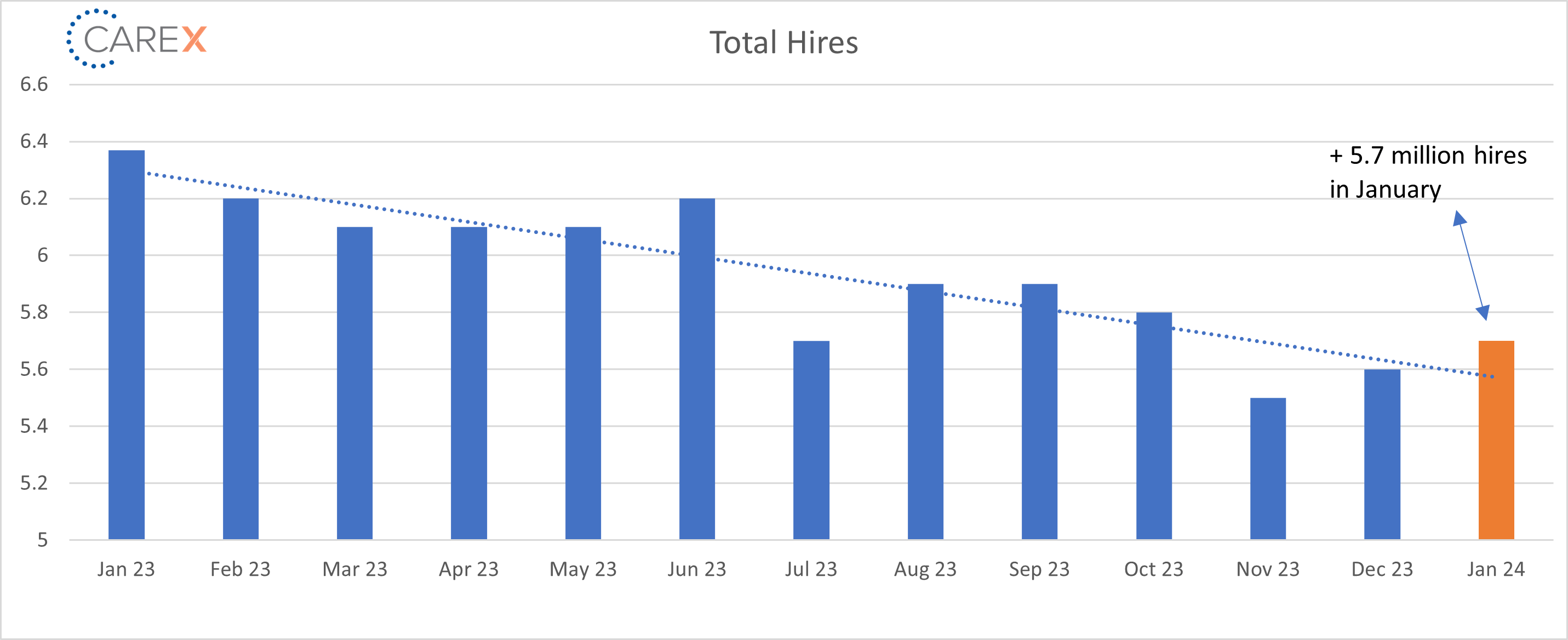

- Hires increased slightly to 5.7 million, a slight increase from 5.6 million the previous month.

- Layoffs remain unchanged at 1.6 million.

- The layoff rate stayed at ~1% for the 5th consecutive month.

- The number of layoffs remains very low by historical standards.

- Quits remain unchanged for the second straight month at 3.4 million.

- Down from 3.6 million three months ago, and 3.7 million four months ago.

- Quits, which are seen as a measure of worker confidence in the ability to change jobs and find another one, continue to remain very steady (and very low).

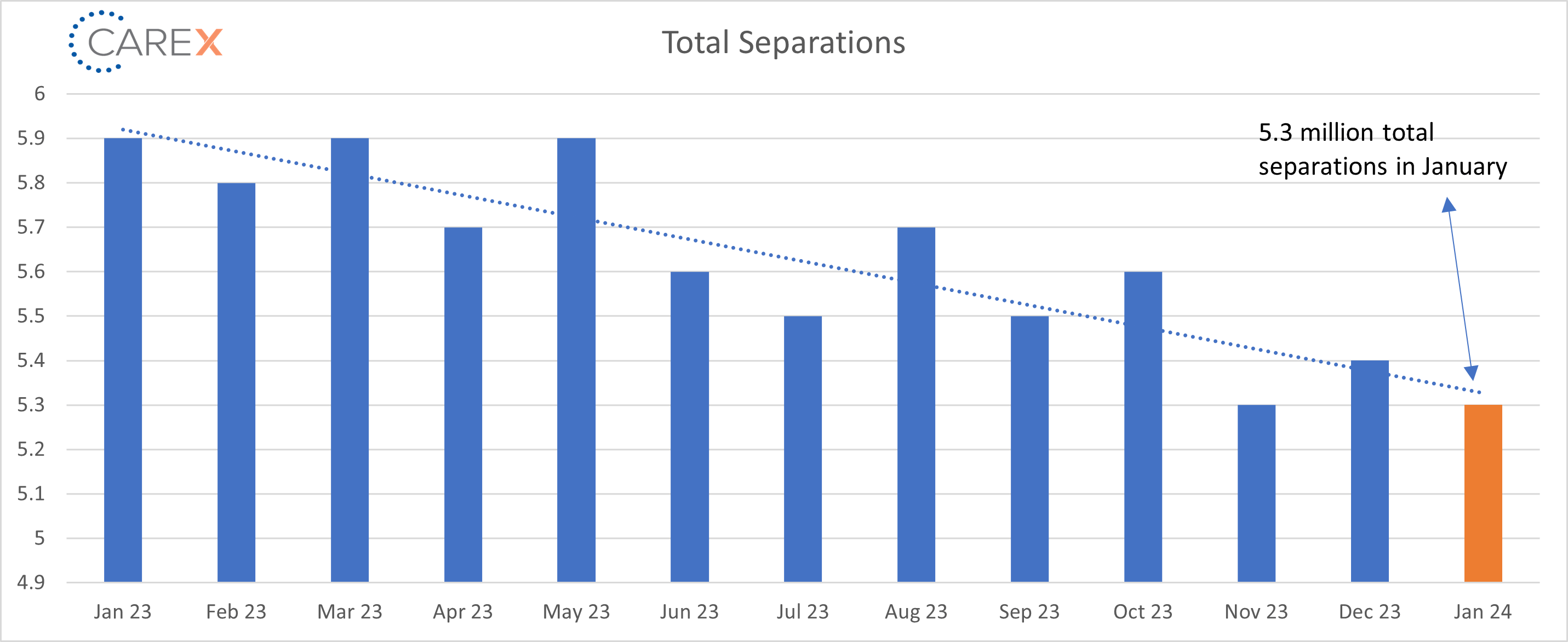

- Total separations decreased slightly to 5.3 million, down from 5.4 million.

- Down from 5.6 million three months ago.

- Jobs per available worker stayed steady at 1.4:1.

- Noticeably down from 1.8:1 last summer.

- This ratio averaged ~2:1 over the past 2 years.

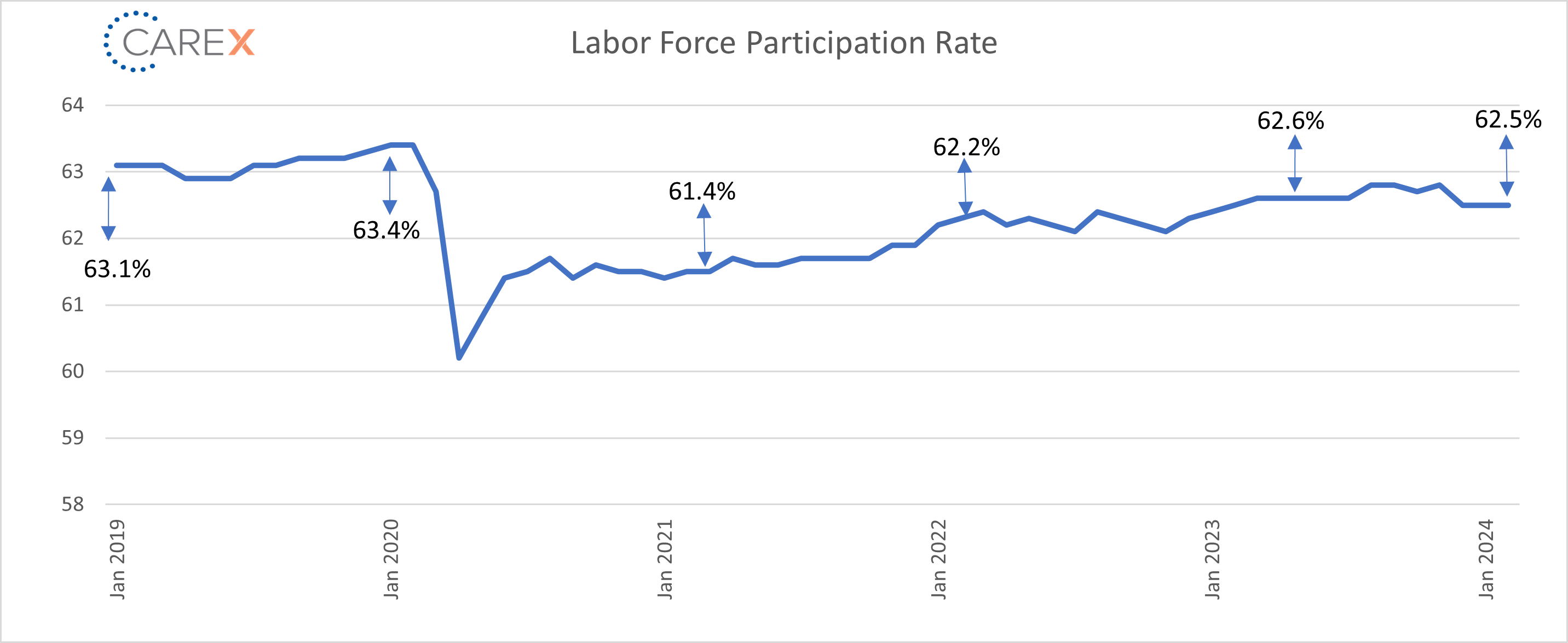

- Labor Force Participation Rate (LFPR) remained unchanged for the third straight month at 62.5%.

- It hit a high of 67.3% in early 2000 and fell to 63.3% in the month before the onset of the pandemic.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email here! While you’re here, make sure to check out the other resources we have available.