New job reports were just released! Here’s our labor market insights for May 2024.

Key Takeaways:

Of all the variables impacting the future of the labor market, AI seems to be the biggest question mark (and, according to many, threat). There’s no question AI will impact the labor market. The real question is—how much? It’ll certainly change the job landscape, but will it move the needle on unemployment? Long term, my suspicion is that it might have less of an impact on the overall labor market than many think. It’s not just AI we should be aware of, there’s also a massive shift in demographics at play.

In terms of supply and demand (employees and open jobs), both are changing. If you know me, you’ve inevitably heard me discuss population and demographic trends (and likely my daft analysis of the Packers draft). To understand AI’s impact on the labor market, it’s important to understand the shifting labor pool.

Let’s zoom out and consider a few data points:

Birth Rates:

- The U.S. has generally been below the “population replacement” rate (which is ~2.1 births per woman) since 1971.

- U.S. fertility rates in 2023 reached the lowest levels on record (falling below the previous record set in 2020).

- Birth rates in the US have declined by nearly 20% since 2007.

Aging Population:

- The median age of the U.S. population has increased by roughly 3.5 years since 2000.

- 2021 saw the largest upward shift in the population age ever recorded.

- Deaths outnumbered births in two-thirds of U.S. counties in 2021.

- Some have forecasted that population could drop by 15% between 2025 and 2029 and continue to decline until at least 2040.

We’re also seeing younger generation(s) delay historical milestones that impact both professional and personal paths:

Delay of “Typical Adulting Behavior” and Changing Professional Norms:

- ~45% of people aged 18 to 29 are still living at home with their parents.

- The typical age to buy a first home has jumped to 36 years old (the oldest ever on record).

- Baby Boomers made up 39% of home buyers in 2022, compared with 28% for millennials.

- Traditional college-going age population is expected to dramatically drop in 2025.

- After peaking in 2010, undergraduate enrollment dropped from roughly 18.1 million students that year to about 15.4 million in 2021.

- Birth rate decline is why the traditional college-age population in the U.S. will start to shrink dramatically beginning in 2025 and lasting until 2037.

- Workers are changing jobs at a high rate of frequency (and the rates are increasing):

- Between the ages of 18 and 24, people change jobs an average of 5.7 times.

- Between 25 and 34 years old it is 2.4.

- From 35 to 44 years of age, the average decreases to 2.9 jobs.

- And then to 1.9 jobs from 45 to 52 years of age.

The labor imbalance is already here, and AI’s impact on jobs is upon us. The shrinking labor force, coupled with the shifting dynamics of professional norms, may offset some of the impact AI will have on the job landscape. In 2004 I gave a presentation on how “technology” will impact the labor market. We’re still having the same discussion. In 1840 Jean-Baptiste Alphonse Karr already had it figured out—“plus ça change, plus c’est la même chose” (the more things change, the more they stay the same).

Presently, the cooldown in the U.S. labor market over the past two years has been exceptional, with job openings falling dramatically but unemployment barely rising.

Zooming in, here’s a look at this month’s labor market data.

By the Numbers:

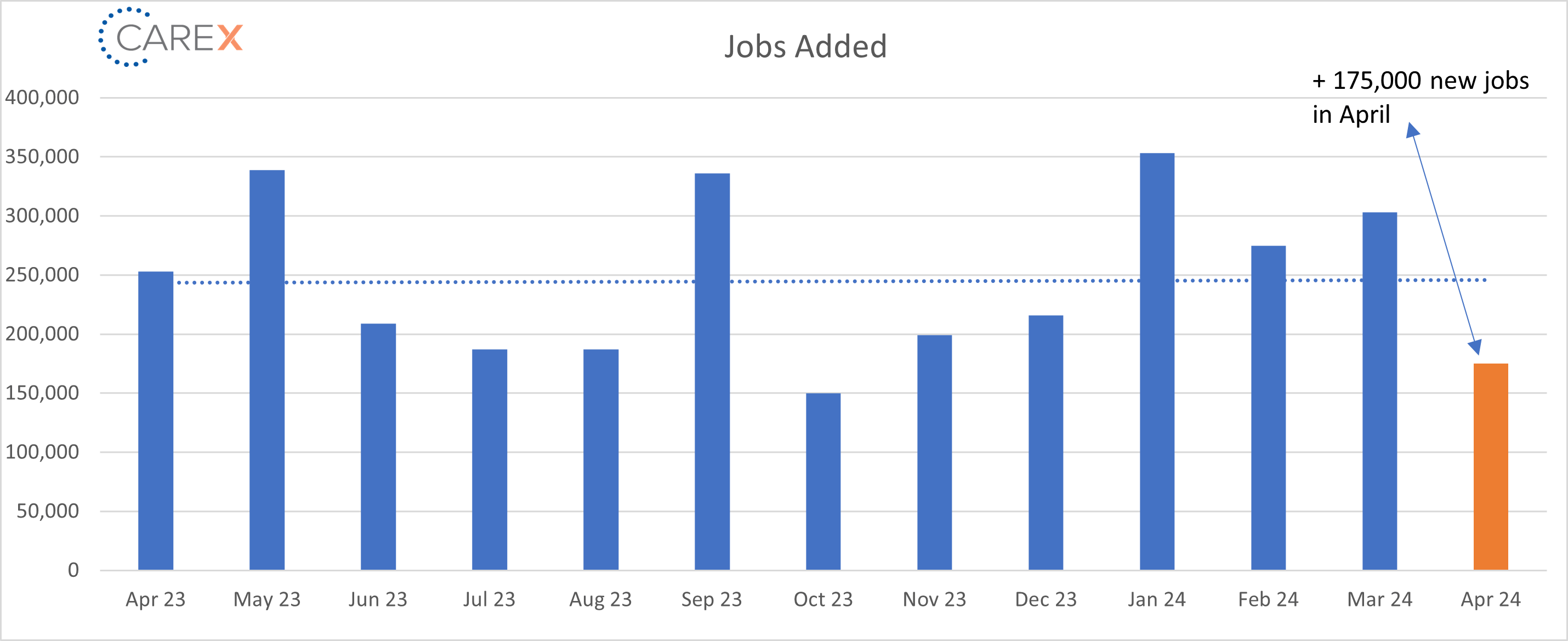

- New Jobs – The U.S. added 175,000 new jobs last month, notably lower than the average monthly gain of 242k over the prior 12 months.

- Job gains were primarily focused in healthcare, social assistance, and transportation.

- Unemployment rose to 3.9%, up from 3.8% the previous month.

- The Fed anticipates (hopes) it’ll hit 4.1% by the end of the year.

- It’s been under 4% for 28 months (a record not seen since the 1960s).

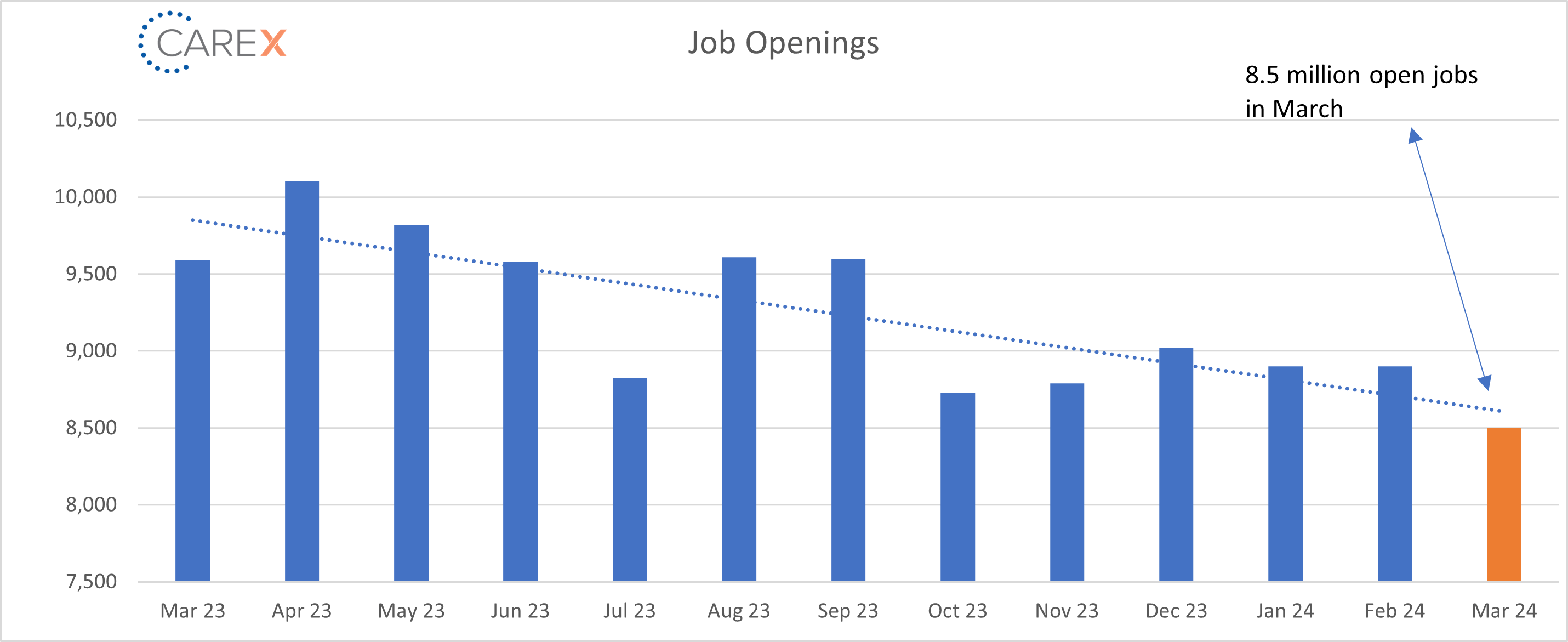

- Job openings dropped again for the third straight month to 8.5 million, down from 8.8 million the previous month.

- Job openings peaked at a record 12.0 million in March 2022.

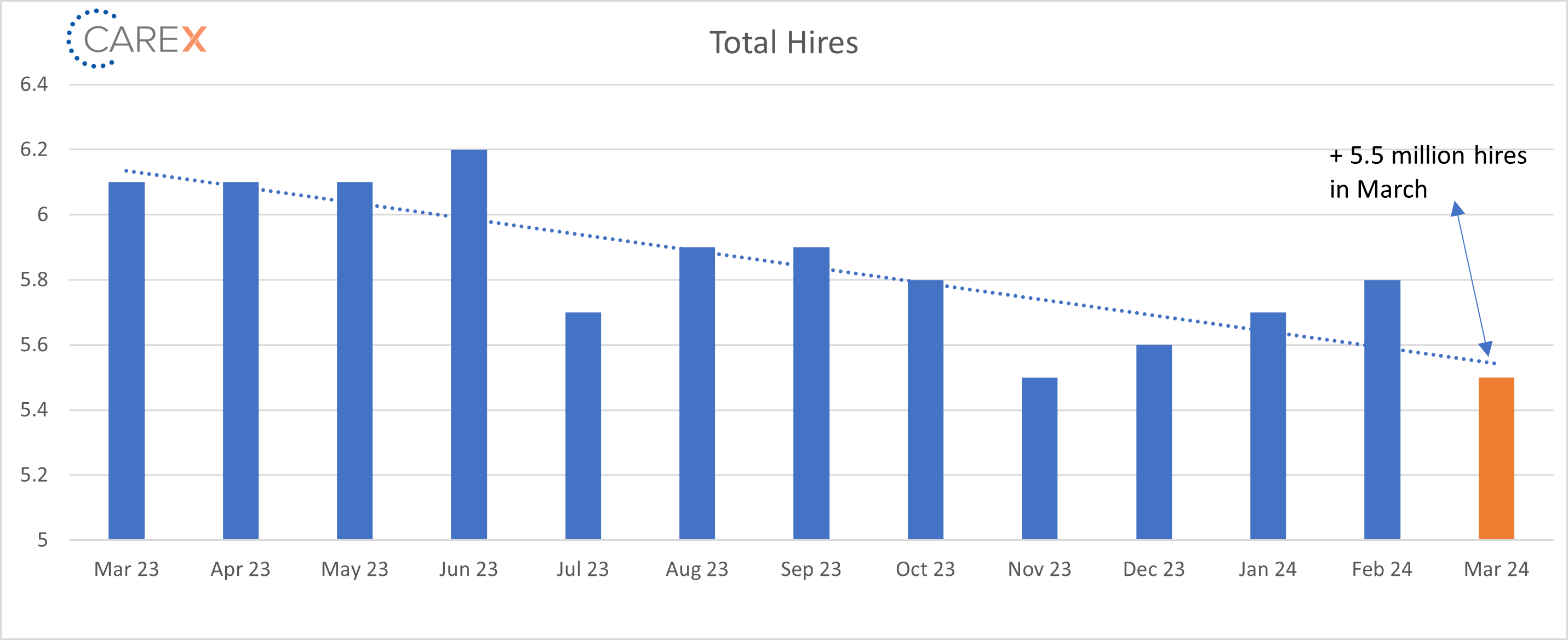

- Hires decreased to 5.5 million, down from 5.8 million the previous month.

- Down from 6.2 million this time last year.

- Layoffs decreased to 1.5 million, down from 1.7 million the previous month.

- The layoff rate stayed at ~1% for the 7th consecutive month.

- The number of layoffs remains very low by historical standards.

- Quits increased slightly to 3.3 million, up slightly from 2.8 million the previous month.

- Quits, which are seen as a measure of worker confidence in the ability to change jobs and find another one, continue to remain very steady (and very low).

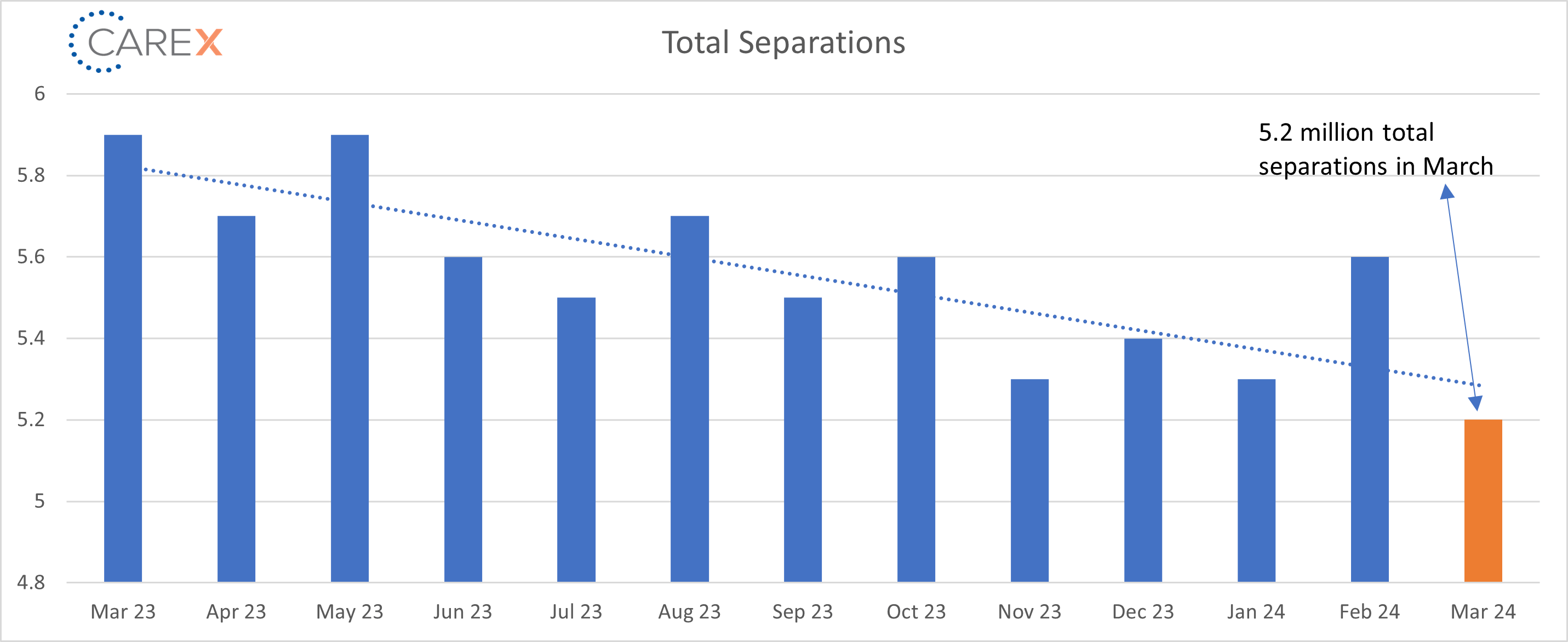

- Total separations fell to 5.2 million, down from 5.6 million the previous month.

- Separations have stabilized across all industries, notably the tech sector.

- Jobs per available worker held steady at 1.3:1.

- Noticeably down from 1.8:1 last summer.

- This ratio averaged ~2:1 over the past 2 years.

- Labor Force Participation Rate (LFPR) held at 62.7%.

- It hit a high of 67.3% in early 2000 and fell to 63.3% in the month before the onset of the pandemic.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email here! While you’re here, make sure to check out the other resources we have available.