Now, here’s our labor market insights for November 2025, written by Matt Duffy (prepared without the use of AI):

Key Takeaways:

For the first time in recent memory, the U.S. job market feels like a TV show that skipped releasing a new episode, and everyone’s checking their phones wondering what happened. When the Bureau of Labor Statistics (BLS) ghosts us, we fill the void with private data, half-baked forecasts, and a little denial. Eventually, we accept that closure might not come, pour another cup of coffee, and tell ourselves, “maybe next month.”

But missing data doesn’t stop us – it just makes us bolder. We build models, adjust assumptions, and announce conclusions with the same authority as a weather forecaster pointing at a green screen. Sure, the odds are 50/50, but if you say it confidently enough, people start to believe you. Right?!

This month, I’ll forgo examining the usual BLS data points (because, well, they don’t exist!). However, there are a few important trend lines emerging that warrant attention – specifically, the rise of layoffs and the evolving relationship between the stock market and the labor market.

Layoffs

Historically, in times of economic uncertainty, companies control labor costs (their biggest expense) in one of two ways: (1) attrition — not backfilling positions after people leave, or (2) layoffs. For the past 18 months, most companies have relied on attrition. In this era, it’s very difficult to find a new job; however, if you have a job, you’re likely safe. Contrary to LinkedIn headlines, the layoff rate has been historically low at around 1%.

Unfortunately, it appears we may be sliding into a new era – layoffs.

A few points to consider:

- Challenger, Gray, and Christmas announced 153,074 job cuts in October, the highest October total since 2003

- The overall labor market has been averaging 1.7 million layoffs per month (and we’re not even in a recession)

- Technology is one of the hardest-hit industries, reflecting post-pandemic over-hiring and the rapid adoption of AI

- Most job-cut intentions in 2025 are also concentrated in tech

- DOGE remains the most cited reason for job-cut announcements this year, while cost-cutting dominated October’s headlines.

The symbiotic relationship between the stock market and the labor market

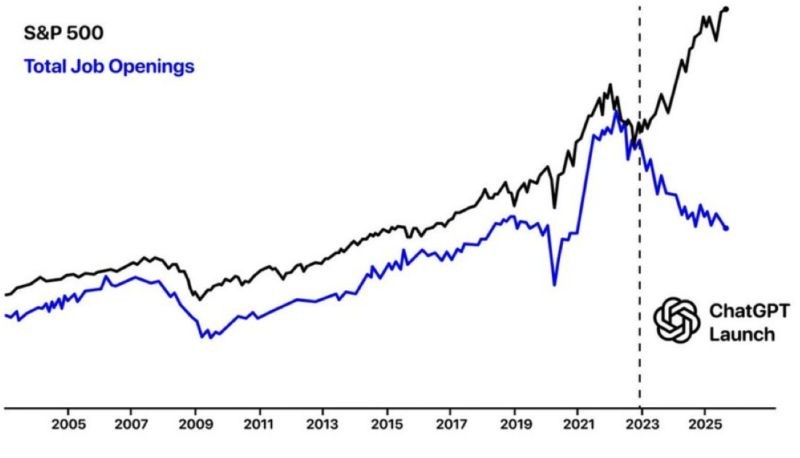

Historically, the labor market and the stock market have been like two dancers – always moving together. Want to get a pulse on one? Just watch the other. The two markets moved in unison – always. Until about two years ago.

Many argue that AI hasn’t impacted the labor market (I’m not one of them). You can debate correlation versus causation all you want, but the data speaks for itself.

On the surface, recent trends are interesting. But the bigger question is: what happens next? As the saying goes, “history doesn’t repeat itself, but it often rhymes.” Does that mean the labor market is poised to rebound? Is the stock market on the verge of dropping? Are we entering an era where these two formerly synchronized markets no longer mirror each other? If so, what does that tell us about our ability to predict where either is headed?

So, what’s next for the labor market?

Probably a little bit of growth, a little bit of slowdown, and a whole lot of “depends on who you ask.” Until the data returns, we’ll rely on vibes, caffeine, and the collective intuition of people who once guessed Wordle in two tries (you know who you are).

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email! While you’re here, make sure to check out the other resources we have available.