The BLS and JOLTS report was just released! Here’s our labor market insights for October 2023.

Key Takeaways:

Sometimes, looking at the big picture can be confusing. The lens through which you perceive data depends on your individual situation: a manager hiring a hard-to-fill job, an unemployed job seeker, or a business leader grappling with recruiting/retention costs. Perspective matters. For example, I’m surprising my daughter with tickets to a Zach Bryan concert. Because tickets are ridiculously expensive (seriously, WTF Ticketmaster?!), we’re sitting in the upper deck. For those sitting stage-side, the experience of the concert will feel very different.

Based on recent data, it would be fair to say unemployment is historically low, layoffs are historically low, and there are close to 10 million open jobs. Telling that to a recently laid off/unemployed tech worker would be tone deaf—recent data would not resonate with that crowd. Similarly, telling a manager who is struggling to fill an engineering position that there are more unemployed people than open jobs, labor force participation is at historic highs, and ~6 million people are being hired every month would only make them question their recruiting tactics.

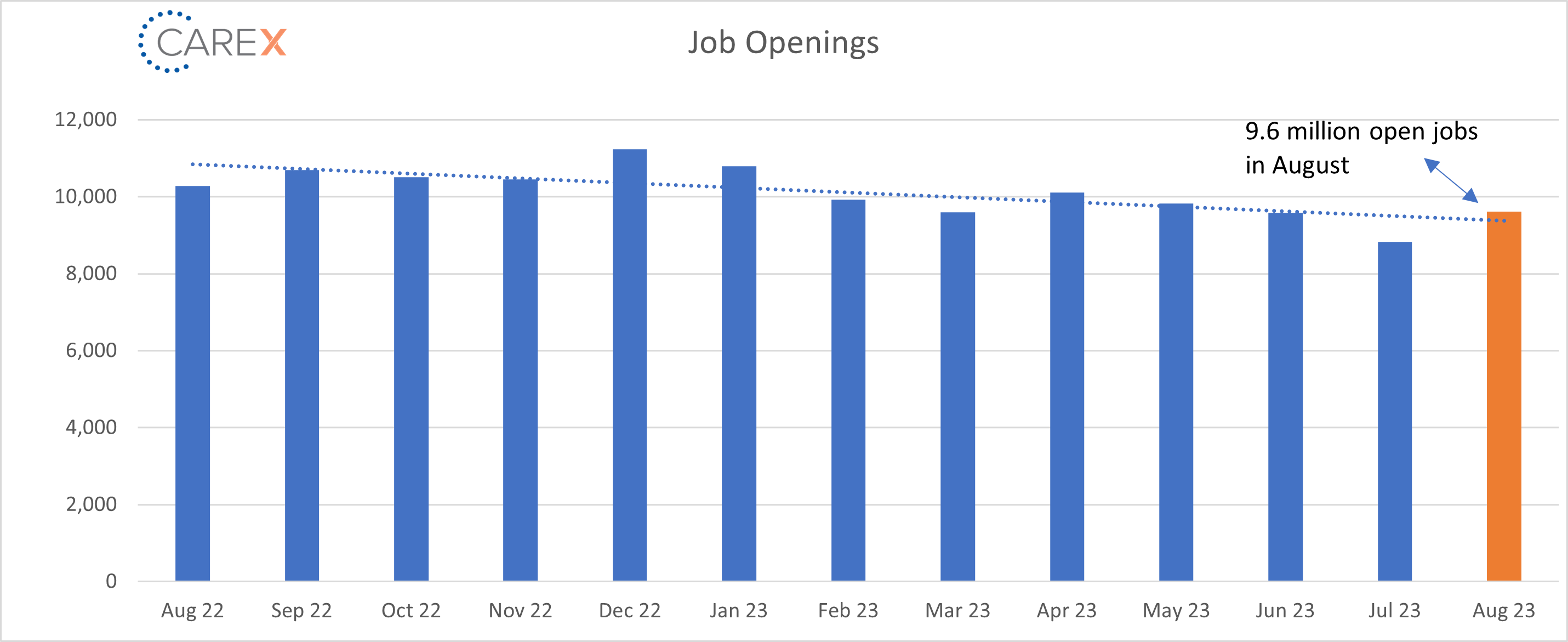

The IT lens is particularly unique. Unemployment in the Technical sector has increased 109% year-over-year, the largest increase of any sector (by a lot). Similarly, this month’s increase in open jobs (jumping from 8.9 million to 9.6 million) was almost entirely driven by Professional and Business Services (+509k). In terms of new jobs added/lost this month, Hospitality added nearly 100k news jobs, while Technology lost 5k positions. Your lens could make the job market feel very stable, or immensely concerning.

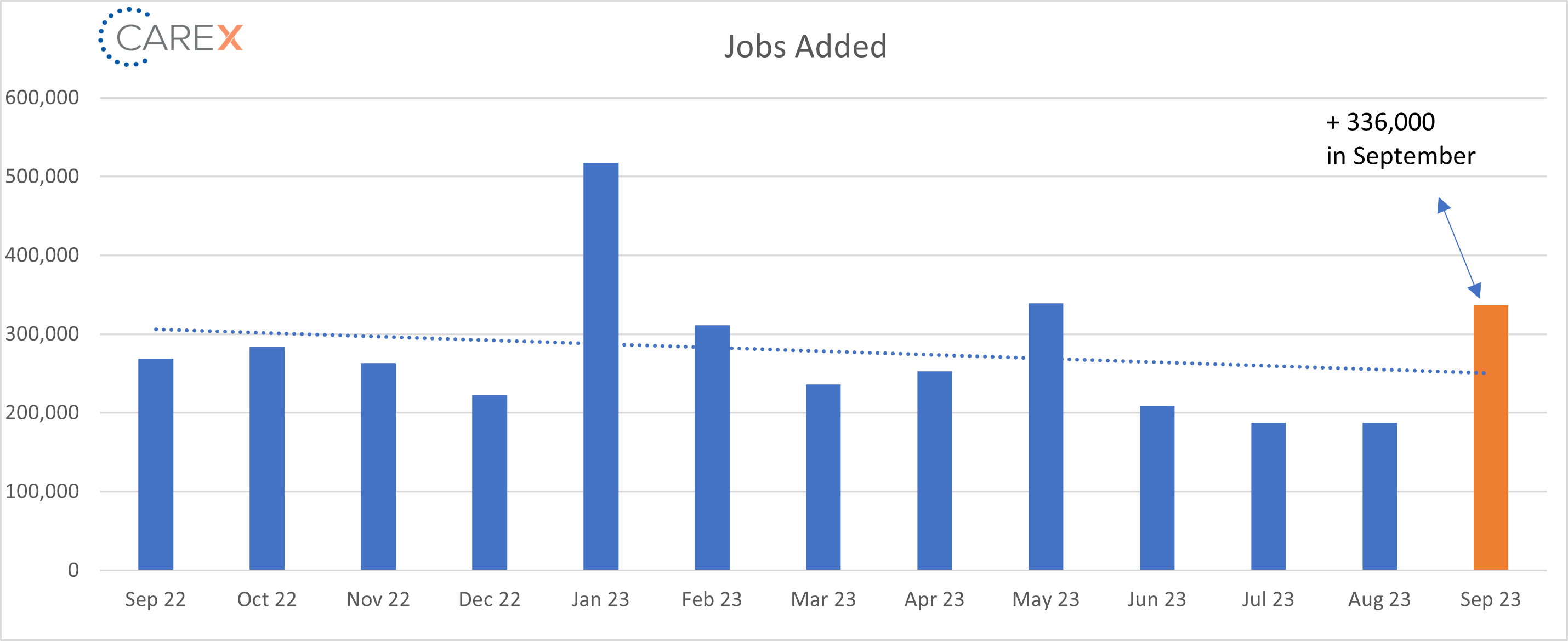

Back to the big picture—from my lens, this month’s data was shocking. The fact we added 336k new jobs blurs sensibility from any lens. The labor market seems to be cooling and heating up at the same time. Ticketmaster pricing seemingly makes more sense than the labor market these days.

By the Numbers:

- New Jobs – The U.S. added 336,000 jobs in September, well above the 187,000 new jobs added last month (chart above).

- Leisure and hospitality saw the strongest job growth with 96,000 jobs added last month (~40% of jobs added).

- Information (Technology) was the only major industry to experience job losses last month—it shed 5,000 positions.

- The 33rd consecutive month of job growth for the United States.

- Unemployment held steady at 3.8%, a slight increase from 3.5% two months ago.

- The highest it’s been since February 2022.

- Job openings shockingly rose to 9.6 million, up from 8.8 million the previous month (chart above).

- Mostly from a sharp increase of 409,000 vacancies for professional and business services.

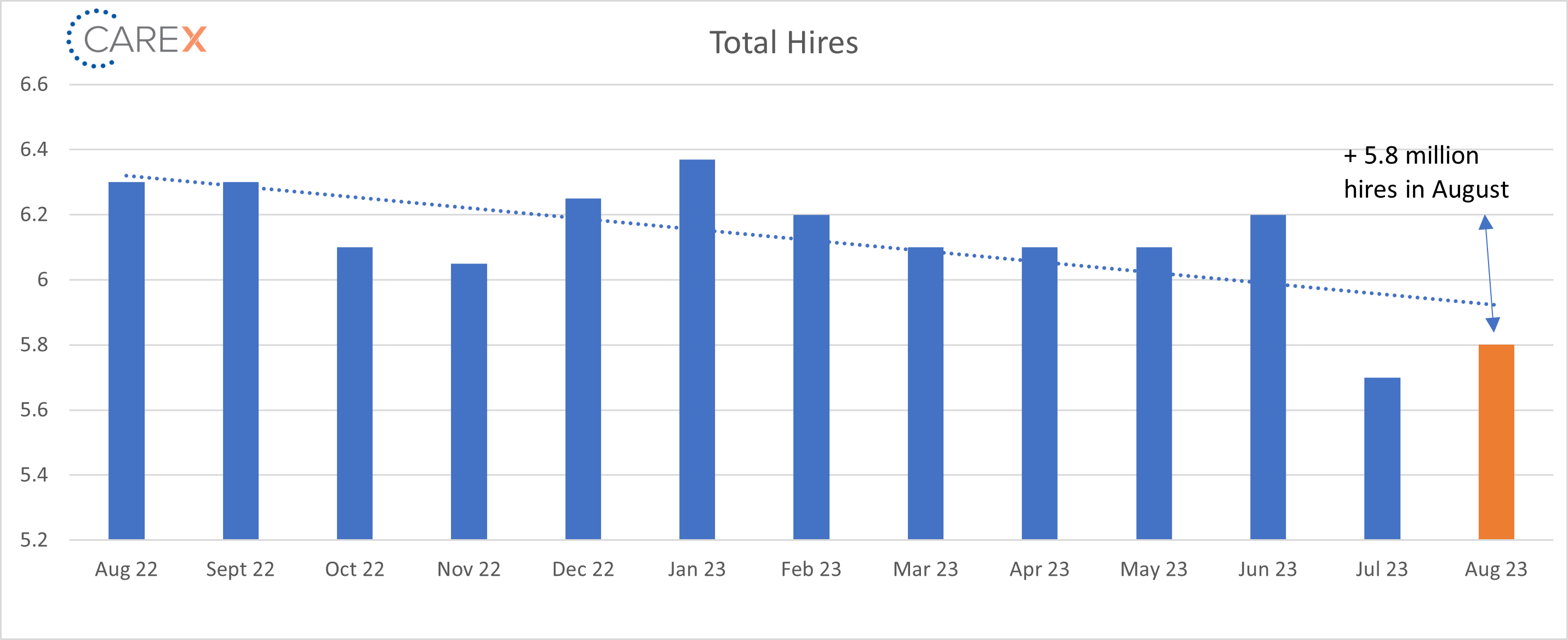

- Hires remained steady at 5.8 million, a slight increase from 5.7 million the previous month (chart above).

- Layoffs increased slightly to 1.7 million, up slightly from 1.6 million the previous month.

- The number of layoffs remains very low by historical standards.

- Quits – The number of people quitting their job increased to 3.6 million, a slight increase from 3.5 million the previous month.

- The quit level hasn’t been this low since early 2021.

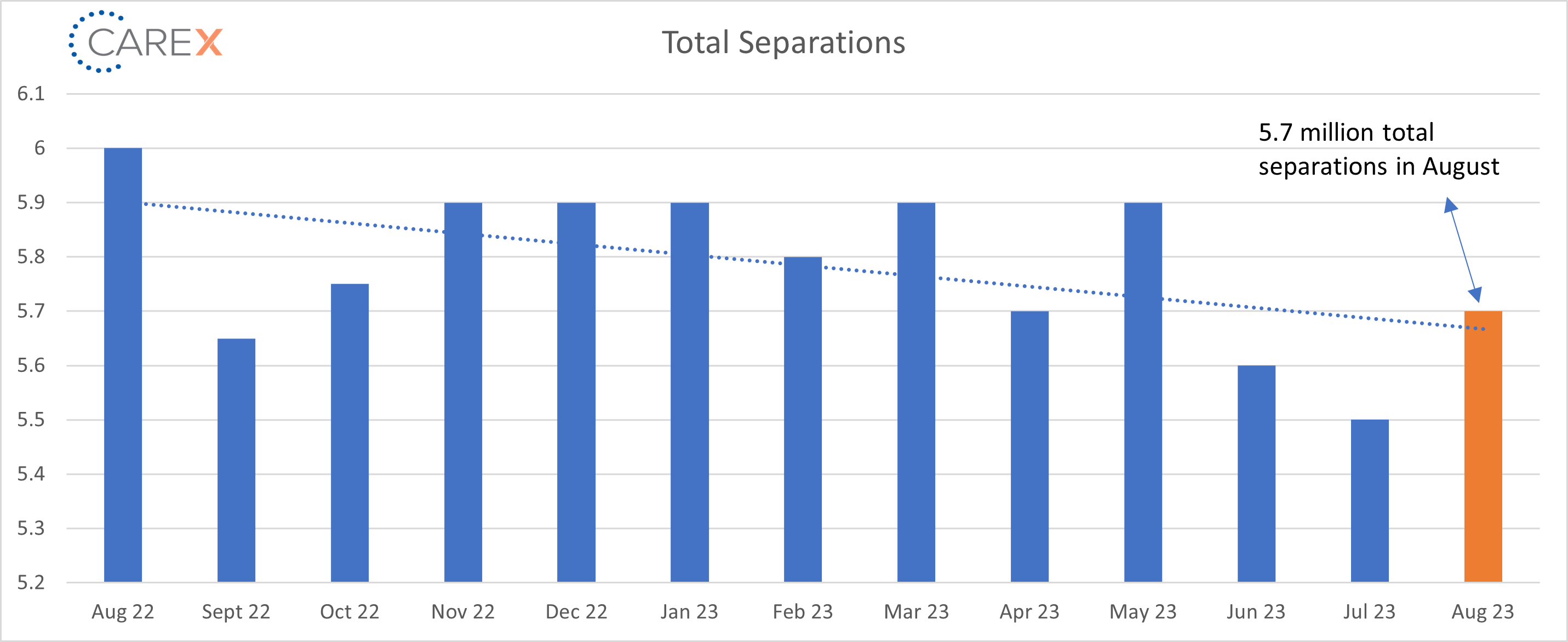

- Total separations increased slightly to 5.7 million, up from 5.5 million the previous month (chart above).

- Jobs per available worker held steady at 1.5, down from 1.8:1 four months ago.

- Six months ago, the ratio was 1.9:1 (and averaged ~2:1 over the past 2 years).

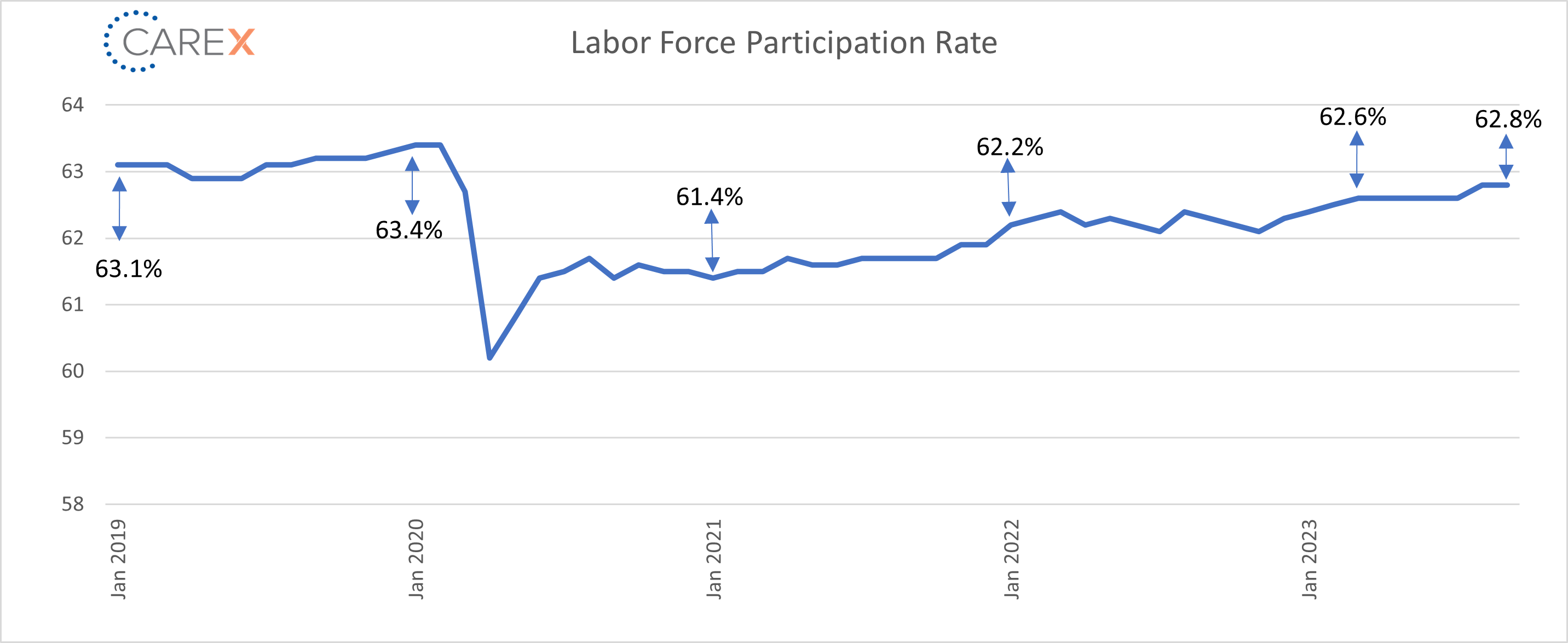

- Labor Force Participation Rate (LFPR) held steady at 62.8%.

- Prime working age Americans with a job is 83.5%—a 22 year high.

- Male participation rate reached its pre-pandemic high at 89.6%.

- Female participation rate continued to drop from its recent high, sitting at 77.4%.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email here! While you’re here, make sure to check out the other resources we have available.